Understanding Mining Company Technicals amid Today’s Turbulence

Many mining stocks saw a revival in prices on Monday, September 25, 2017, since precious metals saw an upswing.

Sept. 28 2017, Updated 3:07 p.m. ET

Technical details

When analyzing mining company stock performances, it’s crucial to take a look at the technical details of the stocks. Many mining stocks saw a revival in prices on Monday, September 25, 2017, since precious metals saw an upswing.

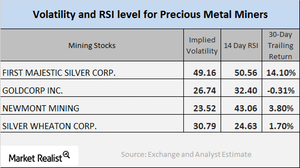

Below, we’ll look at the volatility figures and RSI levels for Alamos Gold (AGI), First Majestic Silver (AG), Goldcorp (GG), and Newmont Mining (NEM).

Implied volatility

Call implied volatility is a measurement tool used for reading fluctuations in the price of the stock with respect to the changes in the price of its call option. On September 25, 2017, Alamos, First Majestic Silver, Goldcorp, and Newmont Mining had call implied volatilities of 45.8%, 53.2%, 28.7%, and 25.6%, respectively. Remember, volatility in mining shares can frequently be greater than the volatilities of the precious metals themselves.

RSI levels

RSI (relative strength index) measures whether a stock has been overbought or oversold. If a stock’s RSI is above 70, it may be overbought, and its price may fall. If a stock’s RSI is below 30, it could be oversold and might correct upward.

The RSI levels for the miners mentioned above have recently undergone some revival. Alamos, First Majestic Silver, Goldcorp, and Newmont now have RSI levels of 28.1, 46.8, 28.7, and 25.6, respectively. The recent decline in these stock prices has led to a considerable fall in their RSIs.

Notably, the Sprott Gold Miners (SGDM) and the iShares MSCI Global Gold Miners (RING) rose 1.9% and 2%, respectively, on September 25, as most precious metals bounced back from their losses the previous day.