Understanding Changes in Analyst Estimates for CLF

Wall Street analysts covering Cleveland-Cliffs estimate revenues of ~$2.4 billion in 2017. This implies growth of 14.7% year-over-year.

Sept. 19 2017, Updated 9:07 a.m. ET

CLF’s earnings drivers

Cleveland-Cliffs’ (CLF) revenues and earnings drivers are quite different from those of its seaborne iron ore peers such as Rio Tinto (RIO), BHP Billiton (BHP), and Vale SA (VALE). Most of its revenues and earnings in US (SPY) (SPX) iron ore are tied to US steelmakers (SLX).

Analysts’ revenue projections for CLF

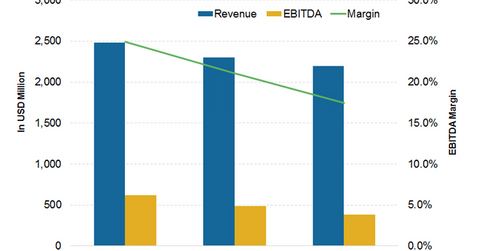

Wall Street analysts covering Cleveland-Cliffs estimate revenues of ~$2.4 billion in 2017. This implies growth of 14.7% YoY (year-over-year). Higher iron ore and US steel prices, along with higher production from the company, are the main drivers for its expected revenue growth.

Similar to other miners, the expected revenue growth for 2018 and 2019 is muted at -4.4% and -3.3%, respectively.

EBITDA estimates

Cleveland-Cliffs’ EBITDA[1. earnings before interest, tax, depreciation, and amortization] estimate for fiscal 2017 is $605.9 million, implying a margin of 25%. The analysts have revised down their EBITDA estimates for Cleveland-Cliffs for 2017, which is in line with Cleveland-Cliffs’ downgrade of its EBITDA guidance from $700 million to $650 million.

Cleveland-Cliffs’ margin for 2017 is much higher than its actual margin of 16.9% in 2016. Higher revenues and lower cost expectations have led analysts to expect a rise in the company’s EBITDA margin.

According to analysts, 2017 could represent a peak in CLF’s EBITDA margins The margins for 2018 and 2019 are expected to be lower at 23.0% and 19.9%, respectively.