Analyzing Shake Shack’s Profitability

We’ll look at Shake Shack’s profitability in terms of its operating and net profit margins. In 2013, it had an operating profit of $5.9 million.

Feb. 2 2015, Updated 10:28 a.m. ET

Profitability analysis

In the last part of this series, we discussed how Shake Shack (SHAK) managed its key costs. Now, we’ll look at Shake Shack’s profitability in terms of its operating and net profit margins.

Margins

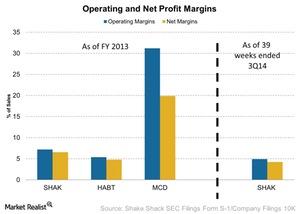

The above chart shows Shake Shack’s operating margins and net profit margins in fiscal year 2013. The chart compares Shake Shack with other restaurants. In 2013, Shake Shack’s operating margins were 6.54%. It had an operating profit of $5.9 million. For the 39 weeks ending in September 2014, the operating margins declined to 4.93%. A single-digit profit margin for a growth company may not be impressive.

How do its peers stack up?

The Habit (HABT) had an operating margin of 5.38%. It had an operating income of $6.4 million. A restaurant’s sheer size can impact margins. For example, McDonald’s (MCD) had an operating profit margin of 31%. It had an operating profit of $8.7 billion. McDonald’s large-scale operations give it economies of scale.

Several restaurants—like McDonald’s, Darden Restaurants (DRI), and Chipotle Mexican Grill (CMG)—are part of the Consumer Discretionary Select Sector SPDR (XLY). You can consider investing in the ETF to reduce transaction costs—instead of investing in several restaurant stocks individually.

To understand how other restaurants compare to Shake Shack, read our series An in-depth overview of the US restaurant industry.

So, should you invest in Shake Shack? We’ll discuss investing in Shake Shack in the next part of this series.