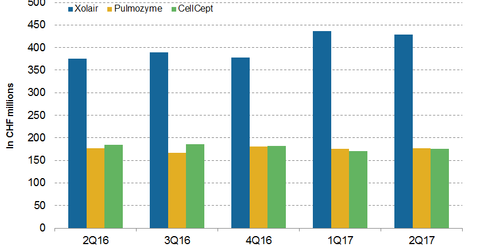

Roche’s Immunology Drugs Xolair, Pulmozyme, and CellCept

In the first half of 2017, Roche’s (RHHBY) Xolair reported revenues of CHF 866.0 million, which is a 17.0% rise on a YoY (year-over-year) basis.

Sept. 25 2017, Updated 7:38 a.m. ET

Xolair revenue trends

In the first half of 2017, Roche’s (RHHBY) Xolair reported revenues of CHF[1. Swiss franc] 866.0 million, which is a 17.0% rise on a YoY (year-over-year) basis. In 2Q17, Xolair generated revenues of CHF 429.0 million, which is a ~14.0% rise on a YoY basis and a 2.0% fall on a QoQ (quarter-over-quarter) basis.

Xolair (omalizumab) is used for the treatment of moderate to severe persistent asthma in individuals aged six years and above and chronic idiopathic urticaria in patients above the age of 12 years who are symptomatic despite H1 histamine therapy.

Pulmozyme revenue trends

In the first half of 2017, Pulmozyme generated revenues of CHF 352.0 million, which reflected a ~4.0% rise on a YoY basis. In that same period in the US and European markets, Pulmozyme generated revenues of CHF 249.0 million and CHF 62.0 million, respectively.

In 2Q17, Pulmozyme generated revenues of CHF 177.0 million, which is a 1.0% rise on a QoQ basis. In 2Q17 in the US market, the drug generated revenues of CHF 124.0 million, which is a ~2.0% rise on a YoY basis.

Pulmozyme (dornase alfa) is used for the improvement of pulmonary function in individuals with cystic fibrosis.

CellCept revenue trends

In the first half of 2017, CellCept reported revenues of CHF 346.0 million, which is a 7.0% fall on a YoY basis. In that period in the US, European, and Japanese markets, CellCept reported revenues of CHF 37.0 million, CHF 88.0 million, and CHF 36.0 million, respectively.

In 2Q17, CellCept generated revenues of CHF 176.0 million, which reflected a ~4.0% fall on a YoY basis and a 4.0% rise on a QoQ basis.

CellCept is used for the prevention of organ rejection in patients having an allogeneic renal transplant, cardiac transplant, or hepatic transplant.

Roche’s peers in the immunology drugs market include AbbVie (ABBV), Johnson & Johnson (JNJ), Bristol-Myers Squibb (BMY), Merck & Co., AstraZeneca, and others. The growth in sales of Roche’s immunology drugs could boost the share price of the Vanguard FTSE All-World ex-US ETF (VEU). Roche Holding makes up ~0.73% of VEU’s total portfolio holdings.