Performance of AstraZeneca’s Other Products in 2Q17

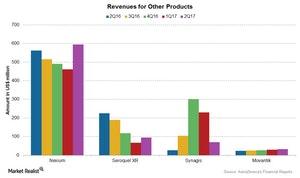

AstraZeneca’s Other Products segment’s revenues fell 12% at constant exchange rates to ~$1.1 billion during 2Q17.

Sept. 6 2017, Updated 9:06 a.m. ET

Other Products segment

AstraZeneca’s (AZN) Other Products segment include products related to infection treatment, neuroscience, and gastrointestinal drugs. Some key drugs in this segment are Nexium, Synagis, Losec, Seroquel XR, and Movantik. The segment’s revenues fell 12% at constant exchange rates to ~$1.1 billion during 2Q17.

This segment’s key products and their performance metrics follow:

Nexium

Nexium, a gastrointestinal medicine for the treatment of acid-related disorders, reported 7% growth in revenues at constant exchange rates during 2Q17. The drug reported revenues of $595 million during 2Q17, following strong demand in the US and established rest of the world markets. These revenues were offset by lower sales in the European markets and emerging markets.

Synagis

Synagis is used for prevention of lung infections and infections related to breathing tubes in infants and children. Synagis reported revenues of $70 million during 2Q17, from which $60 million was reported from the European markets.

Seroquel XR

Seroquel XR, a neuroscience medicine for the treatment of schizophrenia, reported a revenue decline of 58% at constant exchange rates to $95 million in 2Q17. The revenue decline was driven by lower sales in the US, Europe, and the established rest of the world markets.

Movantik

Movantik, a drug for the treatment of opioid-induced constipation, reported 39% growth at constant exchange rates to $32 million in 2Q17 revenues. This growth was driven by strong performance due to increased demand in the US markets.

Losec

Losec is a drug for the treatment of gastroesophageal reflux disease and peptic ulcer disease. Losec reported revenues of $68 million during 2Q17, representing nearly flat revenues at constant exchange rates compared to 2Q16.

To divest company-specific risks, investors can consider the VanEck Vectors Pharmaceuticals ETF (PPH), which holds 4.4% of its total assets in AstraZeneca (AZN). PPH also holds 5.2% in Merck & Co. (MRK), 5.5% in Pfizer (PFE), and 9.1% in Johnson & Johnson (JNJ).