Markets Are Confident on Fed Balance Sheet Trimming Announcement

In its efforts to revive the US economy from the Great Recession, the US Fed started purchasing US government-backed securities in 2008.

Sept. 19 2017, Updated 3:21 p.m. ET

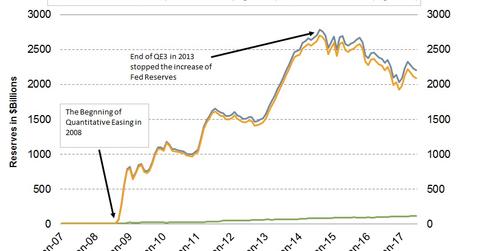

The Fed’s balance sheet

In its efforts to revive the US economy from the Great Recession, the US Fed started purchasing US government-backed securities in 2008. This was an indirect approach to keep the interest rates low after the Fed exhausted its normal monetary policy options. As part of the bond-buying programs, which were also known as quantitative easing programs 1, 2, and 3, the US Fed purchased Treasury (TLT) securities and mortgage-backed securities (MBG). The Fed’s balance sheet size was $147 billion when the program started in 2008 and has now ballooned to $4.4 trillion. Now the economy has improved and the unemployment rate has fallen below 4.5%. The Fed intends to gradually reduce the size of its balance sheet.

How does the Fed want to unwind the balance sheet?

The US Fed has already laid out a detailed plan to unwind its balance sheet. Every month, a set limit of maturing securities won’t be repurchased by the Fed. The details of these limits are as follows:

- For US Treasuries (SHY) (IEI), the FOMC expects to let $6 billion roll off on a monthly basis from its balance sheet. It will increase this amount by $6 billion every quarter until it reaches monthly reductions of $30 billion.

- For agency debt (MINT) and mortgage-backed securities (MBB), this cap would be $4 billion per month, rising by $4 billion every quarter until a cap of $20 billion per month is reached.

Market impact of this announcement

This announcement might not have a significant impact on markets. The limits set by the Fed are very small as compared to the size of the balance sheet, and it could take many years for the Fed’s balance sheet to come back to normal levels. Moreover, there could be increased demand for these maturing securities as the Fed embarks on a rate hike path.