Intuitive Surgical Plans to Expand in Europe and Asia

Although Intuitive Surgical leads the surgical robotics market, there are competitive threats from other major players in the market.

Sept. 1 2017, Updated 10:38 a.m. ET

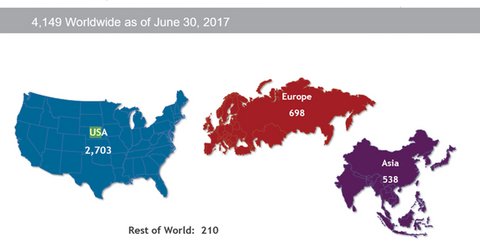

Geographic expansion strategy

In 2Q17, Intuitive Surgical’s (ISRG) core growth was steady in European and Asian markets. The procedure growth in the US was ~14%, while the international sales growth was ~25%. The international sales growth was led by strength in China, South Korea, and Europe. System placements in the US rose ~18% in 2Q17, while the international placement rose ~37%.

European and Asian markets

In 2Q17, Intuitive Surgical launched da Vinci X, which partly contributed to the moderate system placement growth in Europe. The company invested in increasing the human resources in these markets to expand its presence.

In Asia, system placements witnessed slight growth due to the new system quota absence in China and reimbursement challenges in Japan. Intuitive Surgical plans to expand its presence in Europe and Asia. Currently, it’s working through a number of regulatory challenges and locally relevant cost-sensitive expansion strategies. In May 2017, the company launched da Vinci X for cost-sensitive markets. To learn more, read ISRG Expands across Low-Cost Markets with Da Vinci X Launch.

Intuitive Surgical has human clinical trials for da Vinci Sp in progress at three sites in the US and one site in Asia. In Asia, the company has been dealing with cases of urologic, transoral, and colorectal surgery.

Although Intuitive Surgical leads the surgical robotics market, there are competitive threats from other major players in the market. These companies include TransEnterix (TRXC), Medtronic (MDT), and Verb Surgical—a joint venture of J&J (JNJ) and Alphabet. Investors who want to gain exposure to Intuitive Surgical can invest in the iShares Russell 1000 Growth ETF (IWF). IWF has ~0.31% exposure to Intuitive Surgical.