How Gold Is Coping amid Market Turmoil

Precious metals have maintained upward movement over the past month as geopolitical tensions hover.

Sept. 7 2017, Updated 2:44 p.m. ET

Gold movement

Precious metals have maintained upward movement over the past month as geopolitical tensions hover. However, September 5 was a slow day for gold, which recently touched a one-year high of $1,345.60 an ounce. Gold futures for September expiry ended the day at $1,340.60 an ounce. Continued concerns about nuclear tests in North Korea may have boosted haven bids.

Haven bids

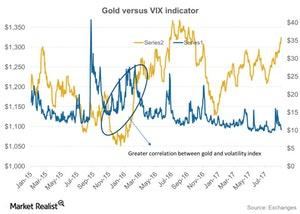

The above chart shows how gold has reacted to overall market volatility. Holdings of the world’s largest gold-backed fund, the SPDR Gold Shares ETF (GLD), have risen over the past week. Whenever investors feel insecure, market volatility (VIXY) is usually higher, which prompts market participants to turn to safe-haven assets such as gold, silver, and Treasuries.

Another major factor in the rise in gold and other precious metals could be the Fed’s delay in hiking interest rates. As opportunity costs of holding gold rise if interest rates rise, with a delay, there is more room for precious metals.

Precious metal stocks that rose on Tuesday and have risen in the past month include New Gold (NGD), Royal Gold (RGLD), Yamana Gold (AUY), and AngloGold Ashanti (AU). These four miners make up ~15.2% of the VanEck Vectors Gold Miners ETF (GDX).