How Green Bonds Can Help Diversify Investor Base

Even if we assume that green bonds don’t offer any significant premium over conventional bonds, there are many who believe in other noteworthy advantages of green investing.

Nov. 20 2020, Updated 3:13 p.m. ET

VanEck

Added Stability From a Diverse Investor Base

Provided that a green bond trades in line with an issuer’s other bonds, what is an investor getting? In a sense, it is a win-win. Green bond investors can potentially earn market rates of return but are also able to direct capital towards projects helping address climate change or other environmental issues. Also, the green label can reduce search costs for investors, along with other indicators such as the Climate Bonds Initiative flag which indicates that the projects financed are in line with the organization’s taxonomy.2 Lastly, the green label may help to diversify the investor base for a particular bond, attracting both traditional fixed income investors as well as institutional green bond investors, which generally take a buy-and-hold approach. This diversity could conceivably help provide stability in a market selloff.

2The Climate Bonds Taxonomy has been designed to be consistent with the Intergovernmental Panel on Climate Change (IPCC) AR5 report for both the emissions signature of a low-carbon economy required to avoid dangerous climate change and the selection of technologies and practices consistent with that signature. Wherever possible the Taxonomy references existing standards.

Market Realist

A win-win solution to investors, issuers, and society?

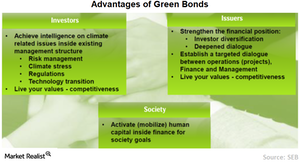

Even if we assume that green bonds don’t offer any significant premium over conventional bonds (TLT) (AGG) (BND), there are many who believe in other noteworthy advantages of green investing. Green bond investing could enhance the transparency of information available to investors on a company’s long-term strategies. Based on this, green investors say they can develop better-informed investment strategies that can balance risk-adjusted returns with environmental benefits. Green investors also point to green investing possibly helping investors implement sustainable climate strategies that could go a long way to create a better world.

Diversify investor base

Since green bond issues are generally smaller in size (often less than $500.0 million) and green investors are naturally concerned about the environment, they may prefer to hold bonds until maturity or over a longer period. that could lead to lower bond volatility in the secondary market. Additionally, liquidity-focused investors are usually less likely to hold green bonds, making them even less volatile than conventional bond holders (BSV) (SHY).

Some claim that green bonds allow issuers to diversify their investor base, which could potentially reduce bond demand fluctuations. They also claim that issuers of green bonds can articulate their sustainability strategies to investors and expand and improve relationships with them. The additional investor demand for green bonds could lead to issue oversubscription.

Support of broader climate policies

Finally, green investors say that green bonds can support the implementation of national and global climate policies. They claim the increase in environmental awareness could lead to a more efficient allocation of capital toward low-carbon projects, which is in line with the global agenda of moving toward ecologically sustainable development.