Does the Green Bond Premium Exist?

Despite the rapid rise in issuance, demand for green bonds continues to outshine supply. The excess demand for green bonds has led to higher returns.

Sept. 18 2017, Published 9:25 a.m. ET

VanEck

Does the Green “Bonus” Create a Premium?

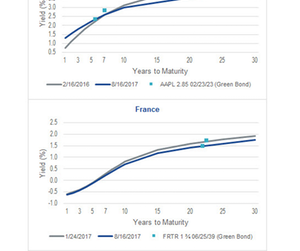

A new study by the Climate Bonds Initiative is the first to take an analytical approach to studying whether or not a green bond “premium” exists. The conclusion? It depends. Some green bonds have priced inside the issuer’s yield curve, some priced on it, and others have priced above. As the report points out, “this is broadly comparable to vanilla bonds”. It is worth noting that the study is somewhat limited in scope, and given the rapid growth and evolution of the green bond market, it may not reflect future market dynamics.

As shown in the charts below, our own analysis of four notable green bond issues also finds that they were generally issued on or slightly above the curve at the time of issuance, and have generally continued to price in line with the issuers’ other bonds in the secondary market.

Intuitively this makes sense. Most investors are not willing to accept a lower yield versus other comparable bonds in the market, despite the green aspect of the bond. While high demand may cause a particular green bond’s yield to tighten in the secondary market (due to buying from those who were not able to get an allotment of the new issue, for example), it is unlikely to deviate significantly versus the issuer’s overall yield curve. Expected growth in new issuance would also help to alleviate supply and demand imbalances. Further while green bonds are generally oversubscribed, this is broadly true across the bond market.

Market Realist

Excess demand may cause scarcity premium

As we saw in the previous part of this series, green bond issuance has increased sharply over the last few years. However, despite the rapid rise in issuance, demand for green bonds continues to outshine supply. The excess demand for green bonds has led to higher returns for these bond holders on many occasions in the past compared to conventional bonds. This statement was supported by HSBC Holdings in its recent report that points to the rising evidence of higher returns generated by green bonds than conventional bonds. As a result, investors have to pay a premium to buy green bonds in the secondary market. A green bond premium is defined as the difference in yield between a green bond and a comparable conventional bond (BND) (SHY).

No conclusive evidence yet

According to Bloomberg’s yield curve analytics, green bonds normally trade at lower yields than conventional bonds (TLT) (AGG) (BSV) of the same characteristics over time, mainly due to the supply-and-demand mismatch. On the other hand, the OECD ( report states that the financial characteristics of green bonds and the comparable conventional bonds from the same issuer are identical on the issue date because investors are unwilling to pay a premium for green investments.

There is no conclusive evidence yet to suggest the existence of a green bond premium. The 2016 study by the Institute for Climate Economics reveals that although increasing demand for green bonds should lower the yield, there is still no clear evidence to suggest that green bonds reduce the cost of capital for their issuers. As more data emerge, it will be interesting to see if the higher demand for green bonds could lead to lower spreads.