How Analysts Estimate Agnico Eagle Mines’ Earnings in 2017 and Beyond

Despite just 0.7% expected growth in revenues for 2017, Agnico Eagle Mine’s EBITDA is expected to grow 5.6% YoY in 2017.

Sept. 19 2017, Updated 9:08 a.m. ET

Factors impacting Agnico’s estimates

Agnico Eagle Mines’ (AEM) operating performance in 2017 has been quite strong. In its latest 2Q17 results, Agnico Eagle Mines beat both its revenue and earnings estimates. Some analysts have revised their estimates higher for the rest of the year as a result of strong year-to-date operational performance.

Agnico Eagle Mines has a strong and consistent execution record. Investors should also note that AEM’s financial and operational leverages are low, which makes it less sensitive to gold price (GLD) movements. Its leveraged peers (RING)—Coeur Mining (CDE), Kinross Gold (KGC), Barrick Gold (ABX), IamGold (IAG), and Yamana Gold (AUY)—are more sensitive to gold prices.

Analysts’ revenue estimates

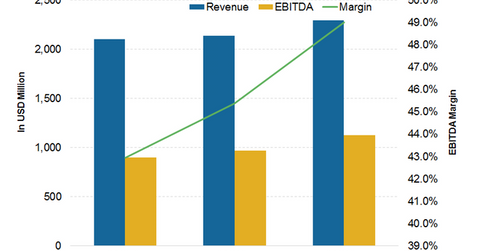

While Agnico Eagle Mines’ production is expected to decline in 2017, analysts’ estimates are estimating a 0.7% growth in AEM’s revenues. The revenues for 2018 are expected to remain flat over 2017.

Agnico Eagle Mines’ projects should start delivering after 2018, which should drive its production growth going forward. The revenues for 2019 are expected to rise 4.4% year-over-year (or YoY).

Investors should also note that Agnico Eagle Mines’ project pipeline is one of the strongest in the gold sector.

Earnings estimates

Despite just 0.7% expected growth in revenues for 2017, Agnico Eagle Mine’s EBITDA[1. earnings before interest, tax, depreciation, and amortization] is expected to grow 5.6% YoY in 2017. Its future margins show even more promise as its costs decline and revenues expand.

Analysts are estimating a margin of 42.4% for 2017, 44.9% for 2018, and 47.7% for 2019. AEM’s upcoming projects should cost less than its current average costs, which could help its margins going forward.