Will the Fed Repeat Its Taper Tantrum Mistakes?

In this cycle of expansion after the great recession, the Fed has started the process of monetary tightening.

Aug. 23 2017, Updated 11:54 a.m. ET

Improved communications from the Fed

In this cycle of expansion after the great recession, the Fed has started the process of monetary tightening. First, it removed the stimulus it introduced in its quantitative easing programs 1, 2, and 3. The announcement of tapering was made in August 2013, leading to extreme volatility (VXX) in the global financial markets. Bond (BND) yields rose significantly as investors expected yields to rise once the largest buyer of bonds, the Fed, stopped doing so. Fortunately, this bout of volatility (VIXY) didn’t last too long, and bond yields returned to lower levels. The Fed learned its lesson and now makes sure to prepare the markets for any future policy amendments. The Fed has raised interest rates five times since December 2015 and is expected to continue doing that if the US economy continues to improve as expected.

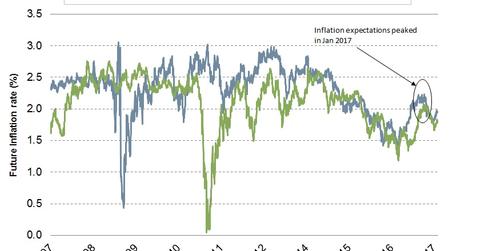

Are the Fed’s inflation projections achievable?

The Fed, as part of its policy normalization program, first tapered its quantitative easing program 3 and then started raising US interest rates. Now it plans to slowly reduce the size of its bloated balance sheet. Throughout their communications, FOMC (Federal Open Market Committee) members have cited improved economic conditions in the United States, low unemployment, and rising inflation (TIP) as reasons for tightening their policy. The recent slowdown in the first quarter was termed transitory, but in the July FOMC meeting, the members felt they could take longer than expected to reach the 2.0% inflation goal.

Market’s view on inflation

The markets remain doubtful that US inflation (VTIP) will reach the 2.0% goal in the near term. Although unemployment levels have reached historical lows, inflation (SCHP) has been lagging. Investors are pricing in a lower probability of inflation reaching the Fed’s target, which was evident with the recent worries about the yield curve flattening.

In the next part of this series, we’ll point out the risks the bond markets are facing.