Will Draghi Lift or Drown the Euro This Week?

The euro-dollar pair (FXE) closed the week ending August 18 at 1.18 against the US Dollar (UUP).

Aug. 22 2017, Updated 7:37 a.m. ET

Euro stays afloat amid geopolitical tensions

The euro-dollar pair (FXE) closed the week ending August 18 at 1.18 against the US dollar (UUP). The shared currency has depreciated by 0.50% in the previous week against the US dollar. Tensions between the US and North Korea have receded, but risk aversion arising out of the US and the terror attack in Spain exacerbated the negative sentiment.

European equity markets (VGK) were volatile and recorded losses in the last two trading sessions. The German DAX (DAX) ended the week up by 1.3%, the Euro Stoxx (FEZ) was up by 1.2%, and the France CAC was up by 1.0% in the previous week.

Euro speculators increase their bets

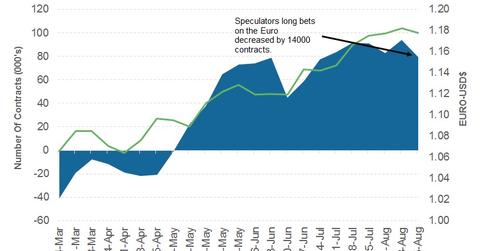

As per the latest Commitment of Traders (or COT) report, released on the August 18 by the Chicago Futures Trading Commission (or CFTC), currency market speculators reduced 14,418 euro long contracts up to Tuesday in the same week. The total net speculative bullish positions on the euro (EUFX) stand at 79,267 contracts as compared to 93,685 contracts in the previous week. Bullish speculative bets have fallen three times in the last four weeks.

The week ahead

Economic data from the European Union that investors should watch this week include the German ZEW economic expectations on Tuesday, PMI numbers for manufacturing, and consumer confidence data on Wednesday. However, the key focus will likely be on Mario Draghi’s speech at the Jackson Hole Symposium in Wyoming. Mario Draghi sowed the seeds for ECB’s quantitative easing (or QE) program at the Jackson Hole symposium four years ago, and he hasn’t been there since then. Markets are now expecting him to announce the tapering of QE anytime. Will he use this stage again? If he does, we could see another rally for the euro in the week ahead.