What’s Ionis Pharmaceuticals’ Valuation?

Ionis Pharmaceuticals (IONS) has been one of the leading pharmaceutical companies in the RNA-targeted therapeutic space for over 26 years.

Aug. 23 2017, Updated 4:35 p.m. ET

A look at Ionis Pharmaceuticals

Ionis Pharmaceuticals (IONS) has been one of the leading pharmaceutical companies in the RNA-targeted therapeutic space for over 26 years. Ionis is focused on developing new best-in-class drugs for life threatening diseases and marketing its approved products in collaboration with other pharmaceuticals companies.

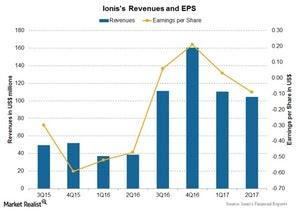

For 2Q17, Ionis Pharmaceuticals reported a net loss of $0.09 per share on revenues of $104.2 million as compared to a net loss of $0.47 per share on revenues of $38.5 million in 2Q16.

Valuation multiples

Generally, the preferred valuation multiples include forward price-to-earnings multiples and forward EV-to-EBITDA multiples. But in the case of Ionis Pharmaceuticals, the company reported a net loss in 2Q17, so we’ll consider the forward EV-to-revenues multiple for the valuation of Ionis Pharmaceuticals.

As of August 22, 2017, the company was trading at a forward EV-to-revenues multiple of 12.2x as compared to the industry average of 4.4x. Incyte Pharmaceuticals (INCY), Regeneron Pharmaceuticals (REGN), and Gilead Sciences (GILD) are trading at forward EV-to-revenues multiples of 15.2x, 8.1x, and 4.2x, respectively.

Analyst recommendations

As of August 22, 2017, Ionis’s stock value has risen 39.2% over the last 12 months. Wall Street analysts estimate that the stock value could rise ~21.9% over the next 12 months. Wall Street analysts’ recommendations show a 12-month targeted price of $56.67 per share compared to the last price of $46.48 per share as of August 21, 2017. Also, out of the 13 analysts tracking Ionis Pharmaceuticals, five analysts recommend a “buy,” seven analysts recommend a “hold,” and one analyst recommends a “sell.” The consensus rating for Ionis’s stock is 2.7, which is a moderate buy for value investors.

To divest company-specific risks, investors can consider ETFs like the PowerShares Dynamic Biotechnology and Genome ETF (PBE), which holds 4.6% of its total assets in Ionis Pharmaceuticals (IONS). PBE also holds 6.2% in Alexion Pharmaceuticals (ALXN) and 5.0% in Amgen (AMGN).