Is Liquidity a Concern for Gold Miners after 2Q17 Earnings?

Newmont Mining had $5.5 billion in liquidity, including $3.1 billion in cash at the end of 2Q17. It has one of the best credit ratings in the sector.

Aug. 18 2017, Updated 10:37 a.m. ET

Liquidity positions

While financial leverage is vital in analyzing a company’s long-term solvency, looking at short-term liquidity profiles of companies is also important. In a weaker commodity price environment, short-term liquidity could come under more pressure, and some companies could be forced to take more drastic measures.

Current ratio

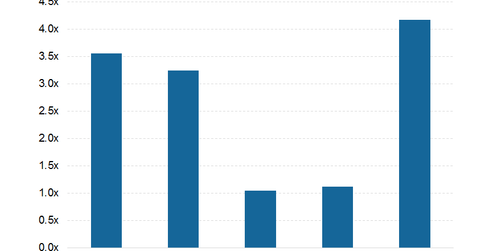

The current ratio is one way to estimate a company’s liquidity. The chart above depicts the current ratios of five gold miners (RING) (GDX). This ratio shows these companies’ respective abilities to pay their short-term obligations using their short-term assets.

Company positions

A higher ratio means a company would be better able to take care of its short-term liabilities and vice versa. Kinross Gold (KGC) and Barrick Gold (ABX) are doing quite well based on this measure, with ratios of 4.2x and 3.6x, respectively. Newmont Mining (NEM) is not far behind with a ratio of 3.2x. Yamana Gold (AUY) has a lower current ratio of 1.1x.

These companies do not seem to be in trouble as far as their liquidity profiles are concerned. Their liquidity positions at the end of 2Q17 were comfortable, with significant debt not set to mature for the next few years. Barrick Gold has only $200 million of debt due before 2020. Also, $5 billion, or two-thirds of its total debt, does not start maturing until 2032.

Newmont Mining had $5.5 billion in liquidity, including $3.1 billion in cash at the end of 2Q17. It has one of the best credit ratings in the sector.

Kinross Gold extended its debt maturities from 2020 to 2021. Its liquidity position with $1.1 billion in cash and cash equivalents at the end of 2Q17 also remains strong.