Bioverativ Expected to Report Robust Revenue Growth in 2017

In 1Q17, Bioverativ reported revenues close to $259.0 million, driven by its focus on a commercial strategy for its hemophilia products and optimal cost management.

July 28 2017, Updated 1:35 p.m. ET

Robust revenue growth

In its 1Q17 earnings conference call, Bioverativ (BIVV) reiterated its 2017 guidance. It expects to report year-over-year (or YoY) GAAP revenue growth of 17.0%–19.0%. It also expects non-GAAP revenues to rise 17.0%–19.0% YoY.

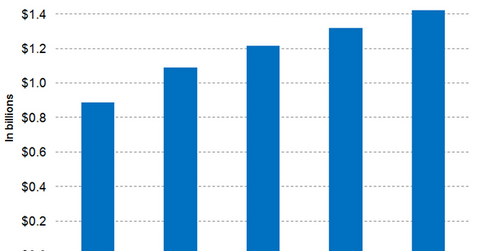

In 2016, Biogen’s hemophilia business reported revenues close to $887.4 million, with Alprolix and Eloctate earning $513.0 million and $334.0 million, respectively.

In 1Q17, Bioverativ reported revenues close to $259.0 million, driven by its focus on a commercial strategy for its hemophilia products as well as optimal cost management. The company is also focused on long-term data for Alprolix and Eloctate to differentiate the drugs as the only hemophilia therapies using Fc Fusion Protein technology.

If Bioverativ reports a robust revenue performance in the remaining quarters of 2017, it may have a positive impact on the company’s stock as well as the iShares Core S&P Mid-Cap (IJH). Bioverativ makes up about 0.41% of IJH’s total portfolio holdings.

Wall Street analysts have projected Bioverativ’s 2017 revenues to be around $1.1 billion, which is a YoY rise of approximately 22.6%.

In 2017, peers Alexion Pharmaceuticals (ALXN), United Therapeutics (UTHR), and Vertex Pharmaceuticals (VRTX) are expected to report revenues of around $3.5 billion, $1.6 billion, and $2.2 billion, respectively.

Long-term data

Bioverativ has published data about the long-term use of Alprolix in Lancet Haematology and Thrombosis and Haemostasis, showing the efficacy and safety profile of the drug as a prophylactic treatment for hemophilia B patients.

Data from the ASPIRE trial has highlighted the efficacy and safety of treating hemophilia A patients with Eloctate for a longer period of time.

In the next part, we’ll look in detail at the projections for Bioverativ.