How United Therapeutics’ Remodulin and Tyvaso Are Performing

In 2Q17, United Therapeutics’ (UTHR) Remodulin generated revenues of around $158 million, which reflected ~8% growth on a quarter-over-quarter basis.

Aug. 31 2017, Updated 10:37 a.m. ET

Remodulin revenue trends

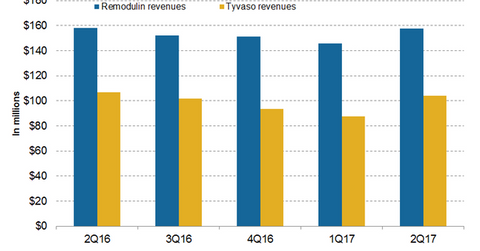

In 2Q17, United Therapeutics’ (UTHR) Remodulin generated revenues of around $158 million, which reflected ~8% growth on a quarter-over-quarter basis. In 1H17, Remodulin reported revenues of around $304 million compared to $298 million in 1H16.

The chart above represents the revenue curve of Remodulin and Tyvaso from 2Q16 to 2Q17. To know more about Remodulin, please read How Is United Therapeutics’ Remodulin Positioned in 2017?

United Therapeutics settled patent litigation with Teva Pharmaceuticals (TEVA), Par Sterile Products, Sandoz, a subsidiary of Novartis (NVS), and Dr. Reddy’s Laboratories in association with its abbreviated new drug application (or ANDA) for marketing authorization of generic versions of Remodulin before expiry of certain US patents of Remodulin. According to the terms of the settlement agreement, Sandoz can commercialize its generic versions of Remodulin beginning in June 2018, while Teva Pharmaceuticals and Dr. Reddy’s can commercialize their generic versions of Remodulin beginning in December 2018.

Tyvaso revenue trends

In 2Q17, Tyvaso generated revenues of around $104 million, which reflected a ~3% decline on a year-over-year (or YoY) basis and 19% growth on a quarter-over-quarter basis. In 1H17, Tyvaso generated revenues of around $192 million compared to $209 million in 1H16. United Therapeutics is conducting various clinical trials for label expansion of Tyvaso. Presently, United Therapeutics is conducting its phase three BEAT trial for the evaluation and demonstration of safety and efficacy of Tyvaso and esuberaprost combination therapy for decreasing morbidity and mortality in individuals with pulmonary arterial hypertension (or PAH) compared to placebo therapy.

In the PAH drugs market, United Therapeutics’ Remodulin and Tyvaso compete with GlaxoSmithKline’s (GSK) Flolan, Actelion’s Veletri Uptravi and Ventavis, Gilead Sciences’ (GILD) Letairis, Pfizer’s (PFE) Revatio, and others. The growth in sales of United Therapeutics’ PAH franchise could boost the share prices of the First Trust Health Care AlphaDEX Fund (FXH). United Therapeutics makes up about ~2.3% of FXH’s total portfolio holdings.