How Novartis’s Sandoz Performed in 2Q17

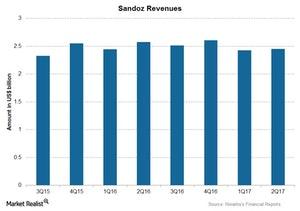

Novartis’s Sandoz reported revenues of nearly $2.5 billion in 2Q17, representing ~20% of NVS’s total revenues.

Aug. 31 2017, Updated 7:38 a.m. ET

Sandoz, NVS’s generics business

Sandoz, the generics arm of Novartis (NVS), is a leader in differentiated generics and includes products difficult to develop and manufacture. Sandoz reported revenues of $2.45 billion in 2Q17, representing ~20% of NVS’s total revenues.

This segment reported a YoY (year-over-year) fall of 5% in revenues in 2Q17, including a 4% fall in operating revenues, a 4% fall in volume growth, and an 8% fall in revenues due to price erosion.

Sandoz product performance

Sandoz’s revenues are driven by biopharmaceutical products, including Zarxio and biosimilars, and were substantially offset in 2Q17 by lower sales from Glatopa and Omnitrope.

In US markets, these products reported revenues of $820 million for 2Q17, or 15% lower YoY at constant exchange rates. In European markets, revenues came to $1.1 billion for the quarter, or 4% higher YoY at constant exchange rates.

Asian, African, and Australasian markets reported revenues of $340 million in 2Q17 for these products—a 3% YoY decline at constant exchange rates.

Biopharmaceuticals

This segment’s biopharmaceuticals portfolio reported revenues of $260 million for 2Q17, or 6% higher YoY at constant exchange rates. This growth was driven by increased sales of biopharmaceuticals in European markets, partly offset by lower sales in US markets.

Notably, the European Commission approved two new biosimilars, Rixathon (rituximab) and Erelzi (etanercept), in 2Q17. Revenues from biopharmaceuticals include revenues from these biosimilars, biopharmaceutical contract manufacturing revenues, and revenues from Glatopa.

Retail generics

Retail generics reported revenues of $2.1 billion for 2Q17, or 5% lower YoY at constant exchange rates. This decline was driven by a 17% fall in revenues from US markets, partially offset by 3% growth in international sales.

Anti-infective franchise

The anti-infective franchise reported revenues of $319 million for 2Q17, which was nearly flat YoY. The company has already discontinued a few low-margin products over the past few quarters, leading to an overall decline in franchise revenues.

To divest company-specific risks, investors can consider ETFs like the VanEck Vectors Pharmaceutical ETF (PPH), which has 6.9% of its total assets in Novartis (NVS). PPH also has 9.1% in Johnson & Johnson (JNJ), 5.5% in Pfizer (PFE), and 4.7% in Eli Lilly (LLY).