How Amgen’s Nephrology Drugs Are Positioned after 2Q17?

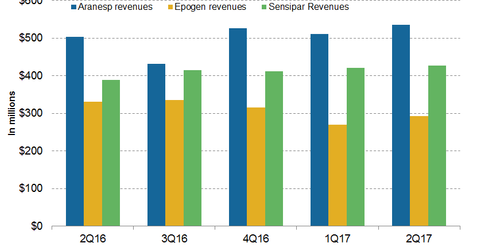

In 2Q17, Amgen’s (AMGN) Aranesp generated revenues of ~$535 million, which represented a 6% year-over-year rise.

Nov. 20 2020, Updated 11:59 a.m. ET

Aranesp revenue trends

In 2Q17, Amgen’s (AMGN) Aranesp generated revenues of ~$535 million, which represented a 6% YoY (year-over-year) rise and ~5% QoQ (quarter-over-quarter) rise. In the US, Aranesp generated revenues of ~$288 million in 2Q17, or ~11% higher YoY.

Outside the US, Aranesp generated revenues of ~$247 million, compared with $244 million in 2Q16. The high unit demand of Aranesp boosted to the revenue growth of the drug worldwide in 2Q17.

The Aranesp (darbepoetin alfa) injection is an ESA (erythropoiesis-stimulating agent) indicated for the treatment of anemia caused by CKD (chronic kidney disease) in individuals on dialysis and not on dialysis. Aranesp is also used for the treatment of individuals with anemia due to side effects from concomitant myelosuppressive chemotherapy. Aranesp’s patents in the US will expire in May 2024, while European patents expired in July 2016. In the European market, Aranesp faces stiff competition from Pfizer’s (PFE) Retacrit.

For more on Amgen’s Nephrology drugs, please refer to Market Realist’s “Amgen Is Managing the Life Cycle of Its Mature Nephrology Drugs in 2017.”

Epogen revenue trends

In 2Q17, Amgen’s Epogen generated revenues of ~$292 million, or ~12% lower YoY and ~8% higher QoQ. The fall in the net selling price was due to a negotiated contract with DaVita, given the decline in revenues from Epogen in 2Q17 compared to 2Q16.

In June 2017, the FDA (US Food and Drug Administration) rejected Pfizer’s biosimilar for Amgen’s Epogen. Many companies are developing biosimilars of Epogen, which could give Epogen stiff competition in the future.

Sensipar revenue trends

In 2Q17, Sensipar (cinacalcet) generated revenues of ~$427 million, which reflected ~10% growth YoY and ~1% growth QoQ. In the US, Sensipar generated revenues of ~$342 million in 2Q17, which was ~13% higher YoY. Outside the US, Sensipar reported revenues of ~$85 million, compared with $86 million in 2Q16. The increase in the net selling price boosted revenue growth in 2Q17 over 2Q16.

Sensipar is used for the treatment of secondary hyperthyroidism in adult individuals with CKD. Amgen’s Sensipar could give stiff competition to Opko Health’s (OPK) Rayaldee.

Notably, Amgen’s peers in the Nephrology drug market include Pfizer, Novartis (NVS), Opko Health, AstraZeneca, and Bristol-Myers Squibb (BMY). The PowerShares Dynamic Pharmaceuticals Portfolio (PJP) has ~5.2% of its total portfolio holdings in Amgen.