Opko Health Inc

Latest Opko Health Inc News and Updates

How Amgen’s Nephrology Drugs Are Positioned after 2Q17?

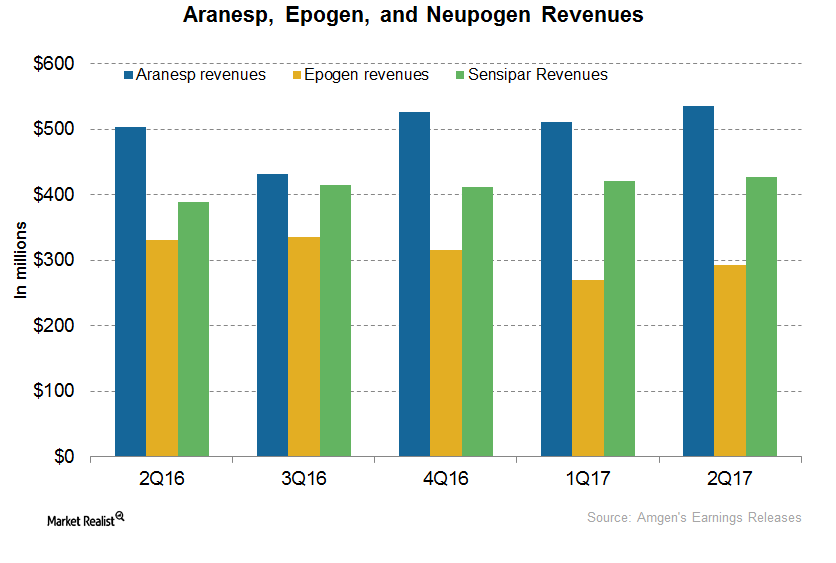

In 2Q17, Amgen’s (AMGN) Aranesp generated revenues of ~$535 million, which represented a 6% year-over-year rise.

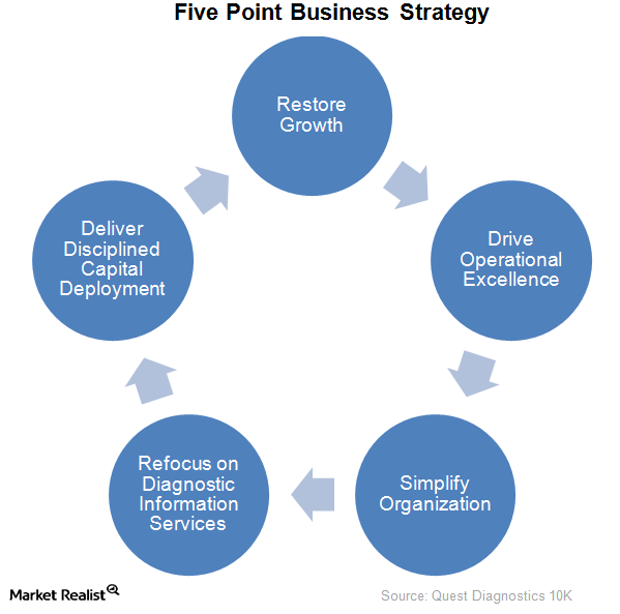

Why Quest Diagnostics’ Five Point Business Strategy Matters in 2016

If Quest Diagnostics succeeds in implementing its five-point business strategy going forward, it should boost the company’s share price and USMV.

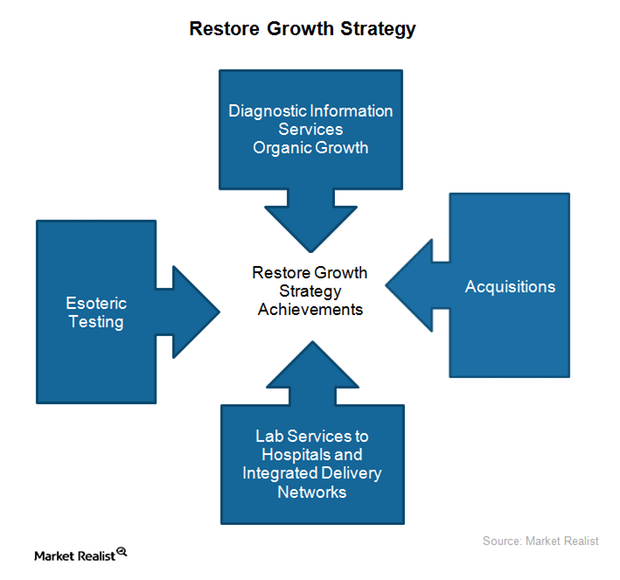

Inside Quest Diagnostics’ Growth Restoration Strategy

Quest Diagnostics has been focusing on developing sales and marketing expertise, increasing esoteric testing, and building relationships with hospitals.