How Does Southern Company’s Dividend Profile Look?

Georgia-based Southern Company (SO) currently offers a dividend yield of 5.2%, the highest among top SPX utilities.

Jan. 18 2018, Updated 4:05 p.m. ET

Southern Company

Georgia-based Southern Company (SO) currently offers a dividend yield of 5.2%, the highest among top SPX utilities. Its dividend yield hasn’t fallen below those of its peers in the last five years.

Though Southern Company’s dividend yield is better than many of its peers, SO significantly lags behind peers in terms of dividend growth. Southern Company’s per share dividends rose 3.6% compounded annually in the last five years. In comparison, broader utilities (VPU) (IDU) increased their per share dividend by around 4.0% compounded annually in the same period.

Dividend profile

Southern Company has a solid dividend payment history, which makes it stand tall among peers. It has increased its per share dividend for the last 15 years. Southern Company aims to increase its per share dividend by around 5% annually for the next few years. Its target dividend growth is in line with the industry average (XLU).

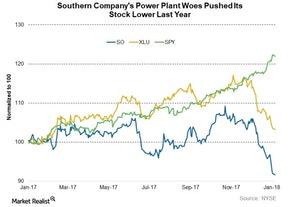

Southern Company stock underperformed peers last year largely due to concerns about its power plants. Goldman Sachs downgraded Southern Company last week on risks due to its Vogtle plant. As a result, the stock saw a two-year low. SO stock fell 8%, while utilities at large rose 7% last year.

You can compare Southern Company’s dividend profile to peers in Market Realist’s Analyzing the Largest S&P 500 Utilities’ Dividend Profiles.