Why Eurozone Manufacturing PMI Dropped in July 2017

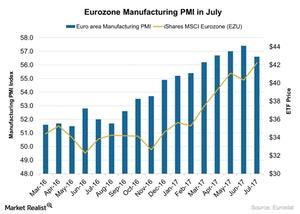

According to a report by Markit Economics, the final Eurozone manufacturing PMI (purchasing managers’ index) stood at 56.6 in July 2017 as compared to the 57.4 in June 2017.

Aug. 10 2017, Updated 9:06 a.m. ET

Eurozone manufacturing PMI in July

According to a report by Markit Economics, the final Eurozone manufacturing PMI (purchasing managers’ index) stood at 56.6 in July 2017 as compared to the 57.4 in June 2017. The PMI figure didn’t meet the preliminary market estimate of 56.8. In June, the manufacturing PMI was at a 74-month high. Various members of the Eurozone such as Germany (EWG), Spain, and France (EWQ) posted a weaker manufacturing PMI in July 2017.

Since July 2016, the Eurozone manufacturing PMI has been on a constant rise. July 2017 was the first time that manufacturing PMI has dropped since then. The softer performance in the Eurozone manufacturing PMI was mainly due to the following:

- Production volume and output rose at a slower pace in July 2017.

- New business orders and export orders also grew at a slower pace in July 2017.

However, employment was higher in July.

Impact on the economy

The Eurozone economy (VGK) (IEV) is showing signs of recovery. Consumer spending is improving gradually, which was reflected in Q2 earnings growth. The strong earnings growth that major Eurozone companies posted is supporting investors’ sentiment towards the economy.

The iShares MSCI Eurozone ETF (EZU) and the Vanguard FTSE Europe ETF (VGK), which track the performance of the Eurozone (HEDJ) (FEZ) (IEV), rose nearly 3.4% and 2.8%, respectively, in July 2017.

In the next part of this series, we’ll look at the manufacturing PMI for the UK (EWU) in July.