Could the S&P 500’s Stalled Ascent Derail Economic Expansion?

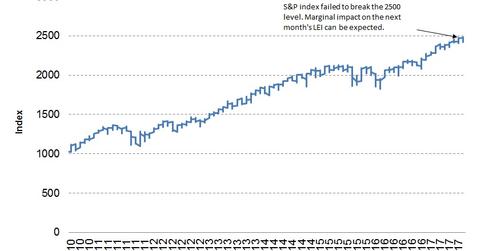

The risk scenario The S&P 500’s rally has stalled just shy of 2,500. Investors are drawn to to riskier assets such as equities when they expect further expansion in the economy. The S&P 500 (SPY), which comprises the 500 largest stocks in the United States, is a constituent of the Conference Board Leading Economic Index […]

Aug. 29 2017, Updated 7:38 a.m. ET

The risk scenario

The S&P 500’s rally has stalled just shy of 2,500. Investors are drawn to to riskier assets such as equities when they expect further expansion in the economy. The S&P 500 (SPY), which comprises the 500 largest stocks in the United States, is a constituent of the Conference Board Leading Economic Index (or LEI). Risk-off developments such as the recent North Korean tensions and the exodus of key members of Trump’s business council could impact the S&P 500’s performance.

The S&P 500’s performance and effect on the LEI

After an impressive run in the last seven months, closing just one month negatively, the S&P 500 is headed for another negative close in August. Plagued by the ascent of risk aversion, US indexes have witnessed a sharp sell-off in recent weeks. Moving forward, political uncertainty surrounding the Trump presidency and the looming debt crisis could impact the S&P 500’s performance.

The S&P 500’s weight in the LEI is 0.04. The S&P 500’s net positive weight in the LEI’s July performance was 0.03 points, or 3%.

ETFs tracking the S&P 500

Major funds that track the performance of the S&P 500 include the SPDR S&P 500 ETF (SPY), the iShares Core S&P 500 ETF (IVV), the Vanguard S&P 500 ETF (VOO), and the PowerShares S&P 500 Low Volatility Portfolio ETF (SPDN). As uncertainty and risk aversion are expected to increase, funds such as the ProShares Short S&P 500 ETF (SH) and the ProShares Short QQQ ETF (PSQ) could witness an increase in demand.