Behind Amgen’s High Revenue Growth from Prolia in 2Q17

Prolia revenue trends In 2Q17, Amgen’s (AMGN) Prolia generated revenues of ~$505 million, which reflected ~15% growth on a YoY (year-over-year) basis and ~19% growth on a QoQ (quarter-over-quarter) basis. In 2Q17, Prolia witnessed ~18% volume growth YoY. Amgen estimated that ~3.5 million patients worldwide are now on Prolia. It estimates that in the US […]

Aug. 14 2017, Updated 11:20 p.m. ET

Prolia revenue trends

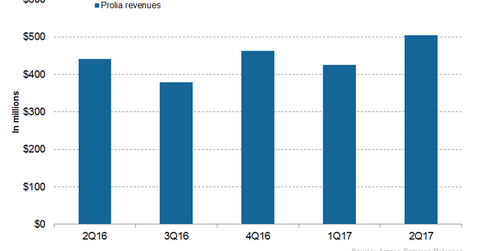

In 2Q17, Amgen’s (AMGN) Prolia generated revenues of ~$505 million, which reflected ~15% growth on a YoY (year-over-year) basis and ~19% growth on a QoQ (quarter-over-quarter) basis. In 2Q17, Prolia witnessed ~18% volume growth YoY.

Amgen estimated that ~3.5 million patients worldwide are now on Prolia. It estimates that in the US and worldwide, ~20% post-menopausal osteoporosis treated patients were on Prolia. AMGN also estimated that in Australia, Switzerland, and Ireland, around 50% treated patients were on Prolia. Its strong clinical profile, proven ability to reduce the risk of fractures, and robust long-term safety data covering more than ten years could strengthen Prolia’s marketing profile.

To know more about Prolia, please refer to Market Realist’s “Prolia Expected to Be a Significant Growth Driver for Amgen in 2017.”

Prolia’s recent regulatory submissions

Amgen is extensively conducting clinical trials for the label expansion of Prolia. In July 2017, Amgen submitted the sBLA (supplemental Biologics License Application) to the FDA (US Food and Drug Administration) for Prolia for the treatment of patients with GIOP (glucocorticoid-induced osteoporosis). Amgen’s sBLA was based on results from a phase-3 study that evaluated the safety and efficacy of Prolia compared to risedronate in patients on glucocorticoid therapy.

Glucocorticoids are administered for the treatment of inflammatory diseases that can lead to osteoporosis. It has been observed that within the first three months of glucocorticoid therapy, BMD (bone mineral density) starts falling significantly, and fracture risk increases by ~75% of patients under treatment.

The phase-3 studies included in the sBLA demonstrated that two-month Prolia therapy led to a statistically substantial gain in BMD at the lumbar spine and hip compared to risedronate, both in patients newly initiating glucocorticoid therapy and those who are on sustained glucocorticoid therapy.

Notably, Prolia gives tough competition to Merck’s (MRK) Fosamax, Eli Lilly’s (LLY) Forteo, and Novartis’ (NVS) Reclast. The growth in sales of Amgen’s Prolia could boost the share prices of iShares Core S&P 500 ETF (IVV). Amgen makes up ~0.60% of IVV’s total portfolio holdings.