Analyzing Copper Miners’ 2017 Production Plans

During its 2Q17 earnings call, Freeport-McMoRan (FCX) lowered its 2017 copper production guidance to 3.7 billion pounds.

Aug. 4 2017, Updated 9:07 a.m. ET

Copper miners’ 2017 plans

Previously, we’ve looked at major copper producers’ 2Q17 production profiles. In this article, we’ll look at the 2017 production guidance provided by leading miners. We’ll also see which miners changed their guidance during their 2Q17 releases.

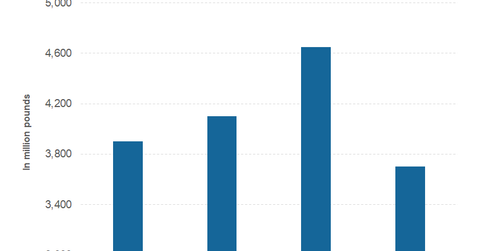

Freeport-McMoRan

During its 2Q17 earnings call, Freeport-McMoRan (FCX) lowered its 2017 copper production guidance to 3.7 billion pounds. This is the second consecutive time that Freeport has slashed its 2017 guidance. During its 4Q16 call, Freeport said that it expects its copper production to reach 4.1 billion pounds in 2017. However, its guidance was slashed to 3.9 billion pounds during the 1Q17 earnings call.

Freeport is not the only company to slash its 2017 guidance. Glencore (GLNCY) also lowered its 2017 production guidance by 25,000 metric tons. Southern Copper (SCCO) lowered its 2017 copper guidance by 10,000 metric tons to 890,000 metric tons during its 2Q17 earnings call.

Guidance

Among other producers, Anglo American maintained its 2017 production guidance of 570,000–600,000 metric tons. Antofagasta also maintained its 2017 copper production guidance of 685,000–720,000 metric tons.

BHP Billiton (BHP) gave copper production guidance of ~1.7 million–1.8 million metric tons for fiscal 2018. BHP’s fiscal year ends on June 30. While BHP expects its copper production to increase in fiscal 2018, it is coming from a low base year. As we noted previously, BHP’s fiscal 3Q17 copper production was negatively impacted due to the labor impasse at Escondida (ILF).

Along with the production figures, we should also watch miners’ cost profiles. In the next article, we’ll look at different copper producers’ unit cash costs.