A Look into Merck’s Immunology and Oncology Portfolio

In 1H17, Remicade generated revenues of around $437 million, which is a 37% decline year-over-year.

Nov. 20 2020, Updated 12:20 p.m. ET

Immunology drugs: Revenue trends

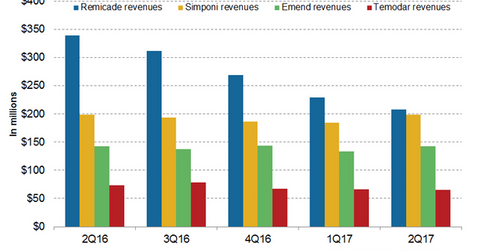

In 2Q17, Merck’s (MRK) Remicade generated revenues of around $208 million, which reflected an ~39% decline on a year-over-year (or YoY) basis and a 9% decline on a quarter-over-quarter basis. Merck commercializes Remicade in Europe, Russia, and Turkey.

In 1H17, Remicade generated revenues of around $437 million, which is a 37% decline YoY. Merck estimated that the foreign exchanges benefited the company by ~3% in both 2Q17 and 1H17. The company lost its market exclusivity in major European markets in 2015. Merck does not have market exclusivity for Remicade in any territories.

In July 2017, the FDA approved Merck’s Renflexis, a biosimilar of Remicade (infliximab). Merck has launched the product in the US market. The regulatory approval and launch of Renflexis could boost Merck’s Immunology segment.

In 2Q17, Merck’s Simponi generated revenues of around $199 million, which reflected 8% growth on a quarter-over-quarter basis. In 2Q16, Simponi generated revenues of ~$199 million. In 1H17, Simponi generated revenues of ~$383 million, which represented an ~1% decline YoY. In 2Q17 and 1H17, unfavorable foreign exchange affected revenues by 3% and 4%, respectively.

Merck’s peers in the immunology drugs market include AbbVie (ABBV), Amgen (AMGN), Biogen, Pfizer (PFE), and Roche. To read more about Merck’s Immunology portfolio, please refer to Inside Merck’s Immunology Portfolio.

Oncology drugs: Revenue trends

In 2Q17, Merck’s Emend generated revenues of around $143 million, which reflects ~8% growth on a quarter-over-quarter basis. In 2Q16, Emend generated revenues of ~$143 million. The higher sales volume in Japan was primarily attributed to the revenue growth in the quarter, which was counterbalanced by a decline in sales volumes in the US market. In 1H17, Emend reported revenues of around $276 million, which is ~3% growth on a YoY basis.

In 2Q17, Temodar reported revenues of around $65 million, which is an 11% decline YoY and 2% growth on a quarter-over-quarter basis. To learn more about Merck’s Emend and Temodar, please read How Merck’s Oncology Drugs Emend and Temodar Could Perform in 2017.

Merck comprises ~4.6% of the PowerShares Dynamic Pharmaceuticals Portfolio ETF (PJP).