A Look at Sanofi’s Post-2Q17 Valuation

Sanofi (SNY), one of the world’s largest pharmaceutical companies, reported operational growth of 5.5% to reach revenue of 8.7 billion euros in 2Q17.

Aug. 16 2017, Published 4:44 p.m. ET

A look at Sanofi

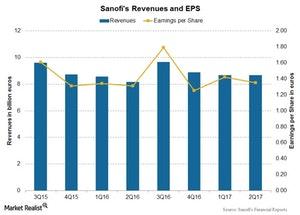

Sanofi (SNY) is one of the world’s largest pharmaceutical companies. As it’s headquartered in Paris, it reports its financial results in euros. In 2Q17, the company reported operational growth of 5.5% to reach revenue of 8.7 billion euros, compared with 8.1 billion euros in 2Q16.

Also, the company surpassed the analyst EPS (earnings per share) estimate of 1.32 euros and reported EPS of 1.35 euros in 2Q17. The above chart compares Sanofi’s EPS and revenue over last few quarters.

Forward price-to-earnings multiples

PE (price-to-earnings) multiples are widely available and represent what one share can buy for an equity investor. On August 16, 2017, Sanofi was trading at a forward PE multiple of ~14.2x, compared with the industry average of 15.3x. Competitors Merck and Co. (MRK), GlaxoSmithKline (GSK), and Novartis (NVS), had PE multiples of 15.3x, 13.6x, and 16.5x, respectively.

Enterprise value-to-earnings multiples

On August 16, 2017, Sanofi was trading at a forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple of 9.9x, which is lower than the industry average of ~11.0x. Competitors Merck and Co., GlaxoSmithKline, and Novartis were trading at multiples of 11.5x, 8.9x, and 15.7x, respectively.

Analysts’ recommendations

Sanofi’s stock has improved by ~19.6% over the last 12 months, and analysts estimate that the stock has the potential to return ~12.9% over the next 12 months. Analysts’ recommendations show a 12-month target price of $54 per share, compared with $47.83 per share on August 15, 2017. Of the 27 analysts tracking Sanofi stock, 11 analysts recommend “buy,” 14 recommend “hold,” and two recommend “sell.” The consensus rating for Sanofi is 2.5, which suggests a moderate buy for value investors. To divest company-specific risks, investors could consider the First Trust Value Line Dividend ETF (FVD) which has a 0.5% exposure to Sanofi (SNY).