Why Investors Should Be Concerned about American Airlines’ Debt

AAL has paid little attention to its total debt, which rose from $20.8 billion at the end of 2015 to $24.3 billion at the end of 2016 and $24.5 billion at the end of 1Q17.

July 13 2017, Updated 7:36 a.m. ET

High debt

American Airlines’ (AAL) debt has been rising as all other carriers have been reducing their debts. AAL’s rising debt has been associated with its preoccupation with solving the integration issues associated with its US Airways merger.

AAL has paid little attention to its total debt, which rose from $20.8 billion at the end of 2015 to $24.3 billion at the end of 2016 and $24.5 billion at the end of 1Q17.

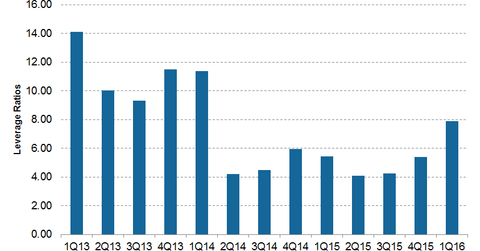

American Airlines’ leverage has also increased. Its net debt-to-EBITDA (earnings before interest, tax, depreciation, and amortization) ratio rose from 5.4x at the end of 2015 to 11.4x at the end of 2016. At the end of 1Q17, its net debt-to-EBITDA ratio was 14.8x, the highest among all major air carriers.

AAL was followed by United Continental with a net debt-to-EBITDA ratio of 9.3x. Alaska Air Group (ALK) had a net debt-to-EBITDA ratio of 4.3x, Spirit Airlines (SAVE) had a ratio of 1.8x, and JetBlue Airways (JBLU) had a ratio of 1.4x. Southwest Airlines (LUV) was the only airline with more cash than debt on its balance sheet.

Cash flows

The cash on American Airlines’ balance sheet could provide some solace to investors. At the end of 1Q17, the company had ~$6.7 billion in cash. Its free cash generated in 2016 stood at $0.7 billion. However, both these amounts seem insufficient compared to its huge debt of ~$24.5 billion.

Future plans

Now that AAL has completed its integration process, its management plans to divert its attention to bringing AAL’s high debt levels down over time, although a clear cut plan isn’t yet available. Details of this plan will be important to listen for in the company’s upcoming earnings call.

Given its high level of debt, things could turn bad for American Airlines very quickly. Investors should keep an eye on AAL’s leverage.

Investors can gain exposure to American Airlines by investing in the PowerShares Dynamic Large Cap Value ETF (PWV), which invests ~1.5% of its portfolio in American Airlines. Continue to the next article to find out whether AAL will increase its dividend payout.