Why Food Stocks Aren’t Cooking

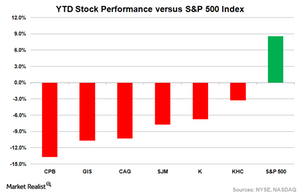

So far this year, food stocks have largely disappointed investors, and the outlook for the rest of the year appears no better. Stock prices for food manufacturers have been on a downtrend, underperforming the S&P 500 Index (SPX-INDEX) on a YTD (year-to-date) basis, as the graph below shows. As of July 3, Campbell Soup (CPB), General Mills (GIS), Conagra Brands (CAG), J. M. Smucker (SJM), Kellogg (K), and Kraft Heinz (KHC) have fallen 13.7%, 10.7%, 10.2%, 7.7%, 6.7%, and 3.3%, respectively, YTD. The S&P 500 Index has returned 8.5% during the same period.

Nov. 20 2020, Updated 12:08 p.m. ET

Part 1: What’s Eating Food Manufacturers’ Stock Prices?

YTD stock performances

So far this year, food stocks have largely disappointed investors, and the outlook for the rest of the year appears no better. Stock prices for food manufacturers have been on a downtrend, underperforming the S&P 500 Index (SPX-INDEX) on a YTD (year-to-date) basis, as the graph below shows.

As of July 3, Campbell Soup (CPB), General Mills (GIS), Conagra Brands (CAG), J. M. Smucker (SJM), Kellogg (K), and Kraft Heinz (KHC) have fallen 13.7%, 10.7%, 10.2%, 7.7%, 6.7%, and 3.3%, respectively, YTD. The S&P 500 Index has returned 8.5% during the same period.

Weak industry trend

Packaged food manufacturers in the United States (SPY) are grappling with weak consumption trends. A shift in consumer tastes toward health and wellness food is hurting these companies’ volumes. Input cost inflation is also a factor. Increased competition, higher promotional spending, and currency headwinds continue to pressure top- and bottom-line performances.

Notably, the challenges plaguing the industry aren’t likely to subside in the near term and will probably remain a drag for financials. General Mills and Conagra Brands, which both recently reported their quarterly results, have painted a grim outlook for the current fiscal year and are guiding for lower sales.

Challenging retail landscape

In addition to lower demand, the changing retail landscape is also challenging food manufacturers. In fact, a lot has changed in the past month that could shape the future of the retail industry and squeeze profits from food companies.

Competition has heated up among retailers. The expansion of Germany-based deep discounters Aldi and Lidl aside Amazon’s (AMZN) bid to acquire Whole Foods (WFM) indicate a raging price war among retailers and are not good signs for food companies. Retailers might have to reduce shelf space for food products and shift their focus to other products to drive growth, which would likely hurt the performance of food manufacturers.

In this series, we’ll examine particular food stocks and see what’s really driving performances. Continue to the next part for a closer look at Campbell Soup stock.

Part 2: Why Campbell Soup Stock Has Grown Cold

Sluggish performance

Campbell Soup (CPB) stock has fallen ~13.7% on a YTD (year-to-date) basis as of July 3. In the past month, it has fallen 9.6%.

CPB’s sluggish performance in both sales and profitability has disappointed investors, and the company has failed to drive margin growth, despite restructuring initiatives. Weak volumes, input cost inflation, and higher promotional spending have remained a drag.

By contrast, peers including Hershey (HSY), Mondelēz (MDLZ), Kellogg (K), and Kraft Heinz (KHC) have managed to drive margins on the back of cost-saving initiatives.

CPB’s sales and EPS

During the last reported quarter, Campbell Soup’s sales and EPS (earnings per share) failed to meet Wall Street’s expectations and witnessed a YoY (year-over-year) decline, while margins have deteriorated.

The company’s EPS fell 9.2% YoY as sales deleverage, higher input costs, and increased promotions took a toll on profitability. Organic sales fell 1%, reflecting higher promotional discounts. The company’s largest business segment, Americas Simple Meals and Beverages, saw lower sales due to a fall in soups and V8 beverages. Sales in this segment are likely to remain low going forward as a result of declining soup sales.

The Fresh segment’s sales have also been falling recently and are expected to remain low in fiscal 2017 due to production constraints.

Outlook remains bleak

Given its lackluster performance in the past three quarters and its persistent challenges, CPB’s fiscal 4Q17 results are expected to disappoint investors. Its management believes that industry-wide challenges aren’t likely to subside in the near term and that these will continue to impact sales.

The management anticipates that sales will either remain flat or fall 1% in fiscal 2017, though it expects margins to improve on a YoY basis, driven by cost-saving measures. CPB’s bottom-line results are projected to benefit from share buybacks.

In the next part, we’ll discuss what’s dragging General Mills down.

Part 3: What’s Keeping General Mills Stale in 2017?

Soft fiscal 2018 outlook

As of June 3, 2017, General Mills (GIS) stock has fallen 10.7% on a YTD (year-to-date) basis, underperforming the S&P 500 Index (SPX) by a large margin. The company reported better-than-expected fiscal 4Q17 results, but its soft fiscal 2018 guidance didn’t bode well for investors.

General Mills’ sales have fallen for the past eight quarters, and the current fiscal year is expected to continue this trend. GIS’s management projects its organic sales to fall 1.0%–2.0% in fiscal 2018 due to challenging industry trends.

Despite its lower sales, the company managed to generate healthy bottom-line growth. In fiscal 2017, GIS’s EPS (earnings per share) grew 5% YoY (year-over-year) and has benefitted from its restructuring and cost-cutting measures.

However, the company’s bottom-line growth rate is expected to fall in fiscal 2018. Lower sales and higher promotional spending to support new products are expected to remain a drag. GIS’s management anticipates that its adjusted EPS will remain flat or rise 1% in fiscal 2018, including the negative impact of 1% from currency headwinds.

Recovery remains distant

General Mills’ sales are negatively affected by continued softness in its US (SPY) business, and the trend isn’t likely to change anytime soon. Similarly, peers including J. M. Smucker (SJM), Kellogg (K), and Kraft Heinz (KHC) are seeing weak consumption trends in the US, which have impacted their top-line performances.

GIS’s fiscal 1H18 is likely to remain soft, while new product launches are slated to launch in fiscal 2H18. Aside from its home turf, the company’s international business is expected to remain soft, as the strong US dollar will likely impact financials negatively.

Continue to the next part of this series for our analysis of Conagra Brands’ (CAG) YTD stock performance.

Part 4: The Hope of a Conagra Stock Recovery

Grim outlook as growth slows

Conagra Brands (CAG) is currently in the middle of a significant portfolio overhaul. The company is shedding its underperforming brands and optimizing its product portfolio through premiumization. Meanwhile, the company’s focus on innovation, its shift from offering deep discounts, and its recent strategic acquisitions are likely to foster growth.

However, CAG’s efforts to return to a growth trajectory should still take time, and the near-term outlook remains soft as growth slows on the margins front.

Conagra’s management expects its net and organic sales to remain flat or fall 2% in fiscal 2018, as the company’s planned exit from lower-margin businesses and industry-wide softness will likely restrict its top-line growth.

Meanwhile, the company’s adjusted operating margin is projected to be in the range of 15.9%–16.3% in fiscal 2018, indicating an increase of 10–50 bps (basis points). Notably, its anticipated operating margin growth remains well below the 310-bps expansion it generated in fiscal 2017.

YTD stock performance

On a YTD basis, Conagra stock has fallen 10.2% as of July 3, lagging behind the S&P 500 Index and most peers, including McCormick (MKC), Kellogg (K), and Kraft Heinz (KHC). The company’s stock has fallen more than 5% since it reported its fiscal 4Q17 earnings on June 29.

Conagra’s lower-than-expected performance on margins and its management’s slow growth projection for fiscal 2018 have disappointed investors. Some analysts even lowered their target prices for Conagra stock following the company’s tepid growth outlook, which further pushed the stock price down.

Conagra’s top line is expected to remain low going forward, particularly given its strategic exit from non-core and underperforming businesses. Meanwhile, the company’s profitability growth rate is projected to remain low on account of sales deleverage, increased input costs, unfavorable mix, and deflation in certain categories.

Now let’s move to J. M. Smucker.

Part 5: Understanding J. M. Smucker’s New 52-Week Low

Near-term outlook challenged

J. M. Smucker (SJM) stock hit a new 52-week low of $117.47 on June 30, and the company’s fiscal 1H18 results are expected to remain low. On a YTD (year-to-date) basis, SJM stock has fallen 7.7% as of July 3, 2017.

The company’s sales have fallen for the past four quarters, and the first half of the current fiscal year is likely to remain challenging. SJM’s management projects that its 1H18 EPS (earnings per share) will fall on a YoY (year-over-year) basis, as weak volumes, planned promotional expenses, and higher input costs are likely to remain a drag.

Meanwhile, food peers Kellogg (K), Conagra (CAG), and General Mills (GIS) are resorting to new and innovative products to accelerate top-line growth. J. M. Smucker is also banking on new product introductions in fiscal 2018 to drive top-line growth, but increased marketing spending to support new product launches is expected to hurt its margins and bottom-line performance.

Sales to remain low

The company has been seeing a muted top-line performance, with industry-wide weakness and increased competition affecting all its business segments. SJM has witnessed sales declines across all segments, and the trend is likely to continue through the first half of fiscal 2018.

During its last reported quarter, sales in its US Retail Coffee and US Consumer Foods segments fell, reflecting lower volumes and mix. Its US Retail Pet Foods segment also saw increased competition, which led to a fall in volumes and lower net price realization.

The company’s management is projecting its overall sales to improve 1.0% in fiscal 2018 on the back of higher net price realization. But increased competition and weak demand are expected to offset these positives.

Now let’s take a look at Kellogg.

Part 6: Inside Kellogg’s Downtrend: The Story on the Back of the Box

Soft trends in North America

Kellogg (K) stock has fallen about 6.7% on a YTD (year-to-date) basis, as the company’s comparable sales in its key regions have remained muted. Kellogg has been struggling to boost sales in North America, mainly in the US (SPY).

By comparison, peers including Kraft Heinz (KHC) and General Mills (GIS) have also been seeing lower sales in North America on account of weak consumption trends. Kellogg’s 1Q17 comparable sales in North America fell 4.3% in 1Q17 due to lower volumes, and the trend not likely to change in the near term.

Europe to remain challenged

Kellogg’s European business is also in trouble. Comparable sales in the region have plunged 14.8%, reflecting lower sales in its cereal business.

Meanwhile, adverse currency movements have posed further challenges. The management expects its second quarter results to remain soft in the region, as lower volumes, tough YoY comparables, and currency headwinds are projected to affect top-line performance.

Latin America and Asia to witness improved sales

Kellogg’s comparable sales fell 3.8% in Latin America due to the one-time impact of distributor transitions in Central America and Peru. The company is seeing increased sales in its kids’ cereal brands, and the Pringles brand has generated healthy demand in Brazil, Mexico, and Colombia. The region is expected to post strong growth going forward, primarily driven by improved volumes.

Kellogg also continues to generate strong sales in Asia, driven by improved performances in India, Japan, and Korea. The management expects to see higher sales and profitability in this region.

Outlook

Kellogg’s overall sales are projected to remain low in fiscal 2018, as the company is witnessing muted growth in North America and Europe, which accounted for about 86% of its total sales in 1Q17. The company’s management anticipates that full-year sales will fall 3%.

The management expects sales to improve in coming quarters, however, on the back of innovative offerings and an expected rebound in consumption trends. But near-term top-line growth will likely remain muted, given the current weakness across the industry.

In the next and final part of this series, we’ll examine what’s been happening with Kraft Heinz.

Part 7: How Kraft Heinz Is Feeling the Squeeze of Weak Consumption Trends

KHC’s year-to-date fall

As of July 3, Kraft Heinz (KHC) stock has fallen 3.3% on a YTD (year-to-date) basis. In the past month, the company’s stock has fallen ~9.7%.

Weak consumption trends and a changing retail landscape are posing challenges and have restricted growth so far this fiscal year, and the company disappointed investors in its last-reported quarter. Despite seeing 15.1% YoY (year-over-year) growth in its bottom line, KHC’s EPS (earnings per share) fell short of the analysts’ estimate, while lower-than-expected sales and higher input costs have offset benefits from its cost-cutting initiatives and higher pricing.

Kraft Heinz’s sales have fallen across its major regions, including the US (SPY), Canada, and Europe. Its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) has fallen across all segments, reflecting lower volumes and input cost inflation.

Soft near-term outlook

Given the slow start to the current fiscal year and persistent challenges, Kraft Heinz is expected to report weak sales and weak EPS growth in the short term. The company’s management projects sequential improvement in sales, driven by traction in its new innovation-driven products, which include Cracker Barrel Mac & Cheese and Devour Frozen meals. Meanwhile, the company expects its go-to-market activity to normalize in Canada, which should further support sales.

However, weak consumption trends in the US and currency headwinds in Europe will likely keep posing challenges in the near term, restricting sales growth.

KHC’s restructuring initiatives, which are aimed at lowering costs, should continue to supplement margin growth and, in turn, boost EPS. Still, the company’s profitability is likely to be impacted by lower volumes and higher commodity costs.

For ongoing updates on these companies and this industry, keep checking in with Market Realist’s Food Processing page.