What We Can Expect from Eli Lilly and Company in 2Q17

A look at Eli Lilly and Company Headquartered in Indianapolis, Indiana, Eli Lilly and Company (LLY) is a US pharmaceutical company focused on human pharmaceuticals and animal health. Stock price performance Eli Lilly’s stock price has fallen ~4.4% in 2Q17. However, the stock price had risen 10.9% year-to-date as of July 7, 2017. Analysts’ recommendations Wall […]

July 10 2017, Updated 7:39 a.m. ET

A look at Eli Lilly and Company

Headquartered in Indianapolis, Indiana, Eli Lilly and Company (LLY) is a US pharmaceutical company focused on human pharmaceuticals and animal health.

Stock price performance

Eli Lilly’s stock price has fallen ~4.4% in 2Q17. However, the stock price had risen 10.9% year-to-date as of July 7, 2017.

Analysts’ recommendations

Wall Street analysts estimate that the stock has the potential to return ~9.1% over the next 12 months. Analysts’ recommendations show a 12-month targeted price of $89 per share, compared with $81.60 per share on July 6, 2017.

Of the 22 analysts tracking Eli Lilly stock, 15 recommend “buy,” six analysts recommend “hold,” and one analyst recommends “sell.” The consensus rating for Eli Lilly stands at 2.1, which represents a moderate “buy” for long-term growth investors.

Analysts’ revenue estimates

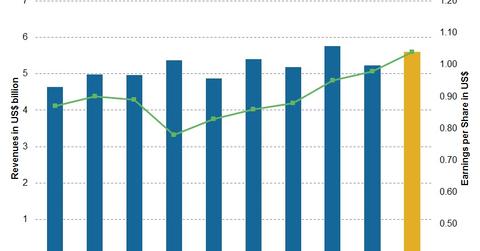

Lilly’s revenue has increased over the past few quarters, mainly driven by the strong performance of pharmaceutical products Trulicity, Humalog, Cyramza, Jardiance, Taltz, and Erbitux. However, drugs Cymbalta and Zyprexa are losing sales to competition due to the loss of exclusivity.

Wall Street analysts expect revenue of $5.6 billion in 2Q17, a 3.5% growth from 2Q16, and earnings per share of $1.04 in 2Q17. To divest company-specific risk, investors could consider the VanEck Vectors Pharmaceutical ETF (PPH), which has a 4.6% exposure to Eli Lilly, an 8.6% exposure to Johnson & Johnson (JNJ), a 4.7% exposure to Teva Pharmaceutical Industries (TEVA), and a 4.9% exposure to Sanofi (SNY).