US Unemployment: The Fed’s Favorite Metric Continues to Improve

In a statement following the conclusion of its two-day monetary policy meeting, the FOMC stated that US labor market growth was solid.

July 28 2017, Updated 10:37 a.m. ET

Labor markets remain robust

In a statement following the conclusion of its two-day monetary policy meeting, the US Federal Open Market Committee (or FOMC) stated that US labor market growth was solid and that the US economy was growing at a moderate pace.

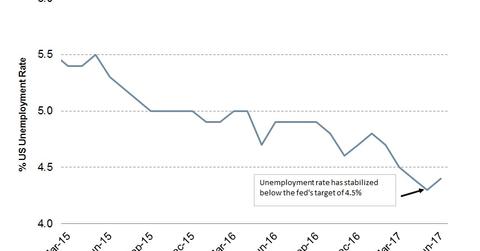

Unemployment and stable prices are part of the dual mandate the Federal Reserve holds when conducting its monetary policy operations. Since unemployment’s peak in October 2009, when the unemployment rate surged to 10%, the US jobs market has seen an impressive recovery.

According to the Fed, this recovery has resulted from the aggressive steps that it’s taken, but that assertion remains a point of debate. The jobs report that was published in the first week of July indicated that non-farm payroll employment had risen by 222,000 jobs and that the unemployment rate was 4.4%.

Unemployment and Inflation

A lower level of unemployment usually leads to a higher rate of inflation (VTIP). The reason for this relationship is that as more people become employed, spending power and disposable incomes rise.

These increased levels of spending lead to higher demand for goods, resulting in higher prices. This relationship hasn’t been working effectively in recent months, though, and that fact remains a worry for the Fed.

Unemployment rate and markets

Unemployment is considered to be a lagging indicator. It’s inversely related to the equity markets (SPY). Changes in unemployment have some impact on the financial markets, only because the Fed is expected to act based on the changes in the labor market. This expectation drives the fixed income (BND) and currency markets (USDU) as soon as the jobs numbers are reported.

Going forward, the unemployment rate is expected to remain low, but it’s inflation growth that will dictate the FOMC’s actions.

In the next part of this series, we’ll analyze the equity market’s (QQQ) reaction to the FOMC’s July statement.