Tagrisso Expected to Be a Key Growth Driver for AstraZeneca in 2017

Launched in Japan in 2Q16, AstraZeneca’s (AZN) 1Q17 revenues for Tagrisso approached $39 million in this major emerging market.

Nov. 20 2020, Updated 12:25 p.m. ET

Tagrisso’s growth trends

AstraZeneca’s (AZN) Tagrisso has been witnessing solid demand trends in its second-line metastatic epidermal growth factor receptor (or EGFR) T790M mutation-positive non-small cell lung cancer (or NSCLC) segment, both in the US and in international markets.

Data from its phase 3 trial, AURA3, has further strengthened the drug’s position as a standard of care treatment option in this indication. AstraZeneca is also anticipating data from the ongoing FLAURA trial and ADAURA trial in 2017. To learn more about Tagrisso’s research programs, please read Label Expansion May Boost Revenues for AstraZeneca’s Tagrisso.

If the company manages sees positive data in these clinical trials, it may have a positive impact on AstraZeneca’s stock price as well as on the Vanguard Total International Stock ETF (VXUS). AstraZeneca makes up ~0.18% of the ETF’s total portfolio holdings.

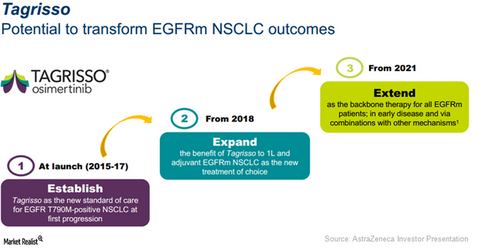

The chart above shows AstraZeneca’s comprehensive strategy for Tagrisso extending until 2021.

Differentiated safety profile

Data from the AURA3 trial, as well as the phase 1 BLOOM trial, has confirmed the efficacy of Tagrisso in those EGFR T790M mutation-positive NSCLC who witnessed disease progression resulting in metastases in the central nervous system.

Further, the company expects that when used as first-line EGFR mutation NSCLC therapy, Tagrisso can also prevent the emergence of T790M resistance in treated patients.

Japanese market trends

Launched in Japan in 2Q16, AstraZeneca’s (AZN) revenues for Tagrisso approached $39 million in this major emerging market in 1Q17. The drug has benefited from the increasing use of companion diagnostic tests in Japan in 2017.

At the end of 1Q17, the testing rate was close to 85%, with 25% of the patients opting for the recently approved blood-based companion test. To learn more about these diagnostic tests, please read AstraZeneca’s Tagrisso Had a Strong Commercial Launch in 2016.

As the only currently approved drug that is effective against EGFR T790M mutation-positive NSCLC, Tagrisso has enabled AstraZeneca to compete effectively with other lung cancer players such as Merck & Co. (MRK), Roche Holdings (RHHBY), and Bristol-Myers Squibb (BMY).

In the next article, we’ll discuss the demand trends for Lynparza in greater detail.