RSI Levels Have Fallen: Will Miners Rebound Soon?

Gold and silver-based funds such as SGOL and SIVR are impacted by changes in precious metal prices. They fell due to the fall in precious metals on Friday.

July 12 2017, Updated 7:40 a.m. ET

Miners fell

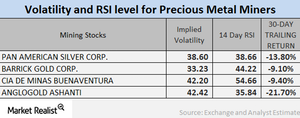

Mining shares saw choppy markets on July 7, 2017, as metals fell substantially. When investors read the mining shares, it’s important to understand crucial parameters like volatility and the RSI (relative strength index).

In this part, we’ll look at some important technical indicators for Alamos Gold (AGI), First Majestic Silver (AG), New Gold (NGD), and Silver Wheaton (SLW).

Call-implied volatility

Call-implied volatility is a measurement of the changes in the price of an asset with respect to changes in the price of its call option. On July 7, 2017, Alamos Gold, First Majestic Silver, New Gold, and Silver Wheaton had implied volatilities of 40.5%, 40.9%, 45.6%, and 47.8%, respectively.

Usually, volatility in mining shares is greater than precious metals’ volatility.

RSI levels

The RSI is an indicator of an asset’s overbought or underbought position.

If an RSI level is above 70, the asset is said to be overbought and the price could fall soon. If an RSI level is below 30, the asset might be oversold and the price could rise soon.

Lately, the RSI levels of the above four stocks have fallen significantly. Alamos Gold, First Majestic Silver, New Gold, and Silver Wheaton have marginal RSI levels of 7.3, 8.4, 3, and 20.4, respectively. Drastically low RSI numbers suggest a possible upward revision in the price very soon.

Gold and silver-based funds such as the Physical Swiss Gold Shares (SGOL) and the Physical Silver Shares (SIVR) are also impacted by changes in precious metal prices. These two funds fell 1% and 2.8%, respectively, due to the fall in precious metals on Friday.