OPEC’s Crude Oil Production Hit a 2017 High

OPEC’s production cut compliance was at 92% in June 2017. Lower compliance from OPEC members and Russia could pressure crude oil prices.

July 3 2017, Updated 12:35 p.m. ET

Crude oil futures

August WTI (West Texas Intermediate) crude oil (USO) (RYE) (VDE) futures contracts rose 0.4% and were trading at $46.2 per barrel in electronic trade at 2:10 AM EST on July 3, 2017. US crude oil prices are near a two-week high.

Moves in crude oil prices impact oil producers like ExxonMobil (XOM), Sanchez Energy (SN), Chevron (CVX), and Goodrich Petroleum (GDP).

OPEC’s crude oil production

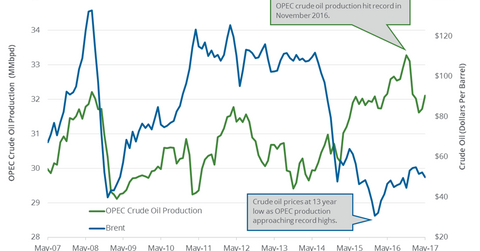

Reuters surveys show that OPEC’s crude oil production rose by 280,000 bpd (barrels per day) to 32.71 MMbpd (million barrels per day) in June 2017—compared to May 2017. So far, it’s the highest level in 2017. Production rose in June due to the rise in production from Libya and Nigeria.

Libya’s crude oil production rose by 90,000 bpd to 820,000 bpd in June 2017—compared to May 2017. Production is near a four-year high. For the latest production figures, read the previous part of the series.

Nigeria’s crude oil production rose by 150,000 bpd to 1.85 MMbpd in June 2017—compared to May 2017. Production is near a two-year high.

Production cut deal

OPEC and Russia entered into production cut deal on May 25, 2017, to reduce crude oil production by 1.8 MMbpd from January 2017 to March 2018. However, it hasn’t successfully reduced US and global crude oil inventories. High production from OPEC in June 2017 could weigh on crude oil prices. OPEC’s production cut compliance was at 92% in June 2017, while it was at 95% in May 2017. The fall in compliance from OPEC members and Russia could also pressure crude oil prices.

In the next part, we’ll discuss some crude oil price forecasts.