Johnson & Johnson: Consumer Products in 2Q17

The consumer segment Johnson & Johnson’s (JNJ) consumer segment revenue rose 1.7% to $3.5 billion in 2Q17, compared with $3.4 billion in 2Q16. This rise includes operational growth of 2.3%, which was offset by a 0.6% impact of foreign exchange. Baby care franchise The baby care franchise reported revenue of $494 million in 2Q17, a […]

July 24 2017, Updated 10:37 a.m. ET

The consumer segment

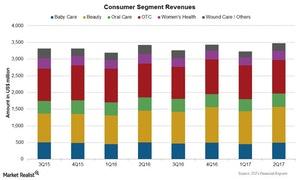

Johnson & Johnson’s (JNJ) consumer segment revenue rose 1.7% to $3.5 billion in 2Q17, compared with $3.4 billion in 2Q16. This rise includes operational growth of 2.3%, which was offset by a 0.6% impact of foreign exchange.

Baby care franchise

The baby care franchise reported revenue of $494 million in 2Q17, a 6.8% fall from 2Q16. This figure includes an operational decline of 6.5% following trade discounting due to competition in US and international markets.

Beauty franchise

The beauty franchise’s sales improved by 10.2% to $1.1 billion in 2Q17, following the acquisition of Vogue International, Light Mask, and NeoStrata in the United States. The growth was also driven by the seasonal stocking effects of Neutrogena Sun products in US markets. However, it was impacted by lower sales in EMEA (Europe, the Middle East, and Africa) markets, and the transition of national value added tax (or VAT) to goods and services tax (or GST) in India.

Oral care franchise

The oral care franchise reported revenue of $394 million in 2Q17, a 2.2% fall from 2Q16. This figure includes an operational decline of 1.7%. Sales in US markets declined due to trade discounts, while international markets reported strong sales of Total Care Zero in Japan and a strong launch of whitening products in China and Korea, with lower sales of toothbrushes.

Over-the-counter franchise

The over-the-counter franchise reported revenue of $1.0 billion in 2Q17, a 1.0% growth from 2Q16. This figure includes operational growth of 2.1%, driven by strong performance by Tylenol in US markets, and anti-smoking aid Quickmist in the Asia-Pacific region and EMEA markets.

Women’s health franchise

The women’s health franchise’s sales fell 2.5% to $276 million in 2Q17, including an operational decline of 3.3%. Sales were majorly impacted by the divestiture of the Tucks brand to Blistex in July 2016.

Wound care franchise

Wound care sales improved by 0.4% to $232 million in 2Q17 due to increased sales of Band-aid and Neosporin products. To divest risk, investors could consider the VanEck Vectors Pharmaceuticals ETF (PPH), which has an 8.6% exposure to Johnson & Johnson. PPH also has a 6.3% exposure to Novartis (NVS), a 5.0% exposure to Novo Nordisk (NVO), and a 4.9% exposure to AstraZeneca (AZN).