Inside GlaxoSmithKline’s 2Q17 Earnings Estimates

For 2Q17, analysts estimate that GSK’s revenues will rise ~11.4% to ~7.3 billion pounds, as compared to ~6.5 billion pounds for 2Q16.

July 25 2017, Updated 4:54 p.m. ET

GSK’s earnings at a glance

Headquartered in the United Kingdom, GlaxoSmithKline (GSK) is one of the leading British multinational pharmaceutical companies. The company reports its financial results in British pounds.

GlaxoSmithKline is set to release its 2Q17 earnings on July 26, 2017.

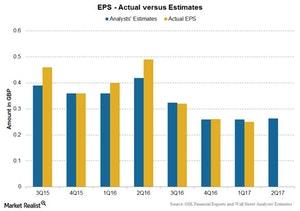

The above chart shows a comparison of the analysts’ estimates with the actual EPS (earnings per share) of GlaxoSmithKline over the past few quarters, as well as the analysts’ estimate for 2Q17. The analysts are estimating EPS of 0.26 pounds for 2Q17.

2Q17 revenue estimates

For 2Q17, analysts estimate that GSK’s revenues will rise ~11.4% to ~7.3 billion pounds, compared with ~6.5 billion pounds for 2Q16. The increase in revenues is expected to be driven by the new pharmaceutical and vaccines products from the respiratory business as well as by immuno-inflammation and HIN products.

Key revenue drivers include HIV products like Tivicay and Triumeq in the Pharmaceuticals segment, meningitis vaccines in the Vaccines segment, and wellness and skin care products in the Consumer Health segment.

Profit estimates

The analysts’ estimates show a gross profit margin of 70.7% for 2Q17, which would be a 3.2% rise over 2Q16. Due to the increase in R&D (research and development) and higher SG&A (selling, general, and administrative) expenses as a percentage of total revenues, the company’s EBITDA margin is expected to fall to 32.7% in 2Q17, compared with 34.4% in 2Q16. The net adjusted income is expected to rise to ~1.3 billion pounds in 2Q17.

To divest company-specific risks, investors can consider ETFs like the VanEck Vectors Pharmaceuticals ETF (PPH), which has 4.8% of its total assets in GlaxoSmithKline. PPH also has 8.6% in Johnson & Johnson (JNJ), 5.0% in Merck (MRK), and 4.7% in Teva Pharmaceuticals (TEVA).