How Precious Metals’ Slump Dragged Mining Shares and Funds Lower

Gold tumbled to an eight-week low on July 3, 2017. Gold futures for August delivery fell almost 1.9% to settle at $1,219.2 per ounce.

July 6 2017, Updated 7:38 a.m. ET

Precious metals slump

Gold tumbled to an eight-week low on July 3, 2017. Gold futures for August delivery fell almost 1.9% to settle at $1,219.2 per ounce. On the day, gold touched its lowest mark since May 10, 2017.

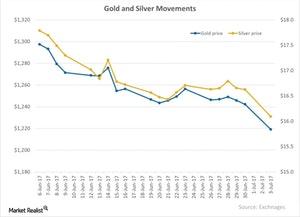

Silver outpaced gold in terms of the day’s losses, tumbling ~3.2% to settle at $16.1 per ounce. Platinum fell 2.2% on the day and ended up at $904.9 per ounce. Palladium’s fall was marginally better at 0.69%, leading it to close at $843.9 per ounce.

The main reason for precious metals’ slump was the revival in equities and the US dollar, which were negative for precious metals and their related mining shares.

The chart above shows how gold and silver have performed over the past month. These metals have fallen ~5% and 9%, respectively, over the past month.

Funds and miners

Mining funds also had a terrible month due to falling precious metals prices. The Direxion Daily Gold Miners ETF (NUGT) and the ProShares Ultra Silver ETF (AGQ) fell 14.2% and 5.3%, respectively, in the past week.

The mining shares that were the biggest losers on July 3, 2017, included silver miners Pan American Silver (PAAS), First Majestic Silver (AG), Coeur Mining (CDE), and Hecla Mining (HL). These four stocks fell 4.3%, 7.6%, 3.7%, and 3.7%, respectively, compared to the previous trading day.

Because silver was the biggest loser among the precious metals, silver miners were likely affected more than other precious metals miners. The above-mentioned four stocks make up a combined ~4.3% of the changes in the VanEck Vectors Gold Miners ETF (GDX).