GlaxoSmithKline’s Valuations after Its 2Q17 Earnings

On July 28, 2017, GlaxoSmithKline (GSK) traded at a forward PE multiple of 13.4x, which is slightly lower than the industry average of 15.2x.

Aug. 3 2017, Updated 7:36 a.m. ET

GlaxoSmithKline’s valuation

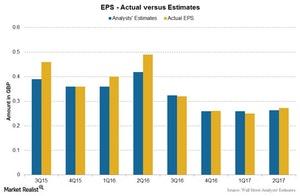

GlaxoSmithKline (GSK) is a British multinational pharmaceutical company with headquarters in Brentford, Middlesex, United Kingdom. For 2Q17, the company reported adjusted earnings per share (or EPS) of 27 pence.

The chart below shows actual and estimated EPS for GlaxoSmithKline since 3Q15. From an investor’s point of view, the forward PE and EV-to-EBITDA multiples are the two best valuation multiples to use when valuing GlaxoSmithKline (GSK) and other large pharmaceutical companies. These companies have relatively stable and visible earnings.

Forward PE

On July 28, 2017, GlaxoSmithKline (GSK) traded at a forward PE multiple of 13.4x, which is slightly lower than the industry average of 15.2x. The company traded at a higher PE than its peers Merck & Co. (MRK), Novo Nordisk (NVO), and Novartis AG (NVS), which traded at forward PE multiples of 15.7x, 17.9x, and 16.9x, respectively.

EV-to-EBITDA

On a capital structure–neutral basis, GSK currently trades at ~8.9x, which is lower than the industry’s average of ~10.4x. Among its competitors, Merck & Co. (MRK), Novo Nordisk (NVO), and Novartis AG (NVS) have forward EV-to-EBITDA multiples of 10.5x, 9.7x, and 15.9x, respectively.

Analyst recommendations

According to the data on July 28, 2017, GSK stock has fallen 9.4% over the last 12 months. However, it rose ~6.3% in 2017 year-to-date. Analysts estimate that the stock has the potential to return ~17.3% over the next 12 months.

Analysts’ recommendations show a 12-month price target of $48.00 per share compared to the last price of $40.93 per share on July 28, 2017. Four analysts track GlaxoSmithKline’s ADR, which is listed on the NYSE. Of these analysts, two analysts recommend a “buy,” and while two analysts recommend a “hold.”

The consensus rating for GlaxoSmithKline ADR stands at 2.0, which represents a moderate buy for long-term growth investors.

Thirty analysts track GlaxoSmithKline stock, which is listed on the London Stock Exchange. Fourteen analysts recommend a “buy,” 14 analysts recommend a “hold,” and two analysts recommend a “sell.” The consensus rating on GlaxoSmithKline stock stands at ~2.5, representing a moderate buy for value investors.

For broad-based exposure to the company, investors can consider the Vanguard Total World Stock ETF (VT), which holds 0.4% of its total assets in GlaxoSmithKline.