Euro Reaches 23-Month Peak: Could It Climb Higher?

Euro rallies to a 23-month peak Last week, the euro (FXE) closed at 1.17, appreciating by 1.7% against the US dollar (UUP). The currency has appreciated by more than 10% against the US dollar this year, making it one of the strongest developed market currencies. Improving economic conditions and a stable political climate turned the […]

Nov. 20 2020, Updated 4:14 p.m. ET

Euro rallies to a 23-month peak

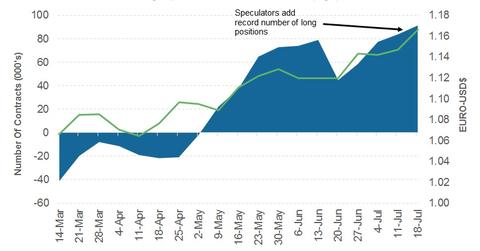

Last week, the euro (FXE) closed at 1.17, appreciating by 1.7% against the US dollar (UUP). The currency has appreciated by more than 10% against the US dollar this year, making it one of the strongest developed market currencies. Improving economic conditions and a stable political climate turned the tide for the euro. The ECB (European Central Bank) met on July 20, and interest rates were not changed. The interest rate was at 0%, and the deposit rate was left at -0.4%. In the press conference following the meeting, ECB chairman Mario Draghi advocated patience for inflation to reach its target rate. He added that discussions about the ECB’s asset purchase program will begin in the fall, and this announcement was sufficient for euro bulls to take the currency above the 1.16 mark. We discussed this possibility last week.

European equity markets (VGK) were dragged lower after the ECB’s meeting and as the euro rallied. The German DAX (DAX) was down 3.1%, the Euro Stoxx (FEZ) was down 2.1%, and France’s CAC was down 2.3% last week.

Euro bulls charging ahead

A small hope for tightening by the ECB prompted euro bulls to drive the currency to a 23-month peak. According to the CFTC’s (US Commodity Futures Trading Commission) latest Commitments of Traders report, currency market speculators had added 7,533 long euro contracts as of July 18. Net speculative bullish positions on the euro (EUFX) stand at 91,321 contracts.

Eurozone data to be in focus this week

Eurozone purchasing managers’ index data from the manufacturing and service sectors and German business climate data and inflation data are due this week. Like the Fed’s statement, the data is likely to be a key driver for the euro. Technically, all indicators are in the overbought zone, though this momentum could continue before a turnaround.