How China’s Fertilizer Export Sector Is Changing

China is the largest consumer of nitrogen fertilizers, but it produces most of it within its borders. Urea is Chinese farmers’ top choice.

Nov. 20 2020, Updated 2:42 p.m. ET

Chinese supply

In the previous part of this series, we saw that China was one of the largest consumers of NPK (nitrogen, phosphorous, potassium). Of the three fertilizer types, nitrogen accounted for 64.0% of China’s total NPK fertilizers consumed in 2014, according to the International Fertilizer Industry Association.

Exports

China is the largest consumer of nitrogen fertilizers, but it produces most of it within its borders. There are several variants of nitrogen fertilizers, but urea is the top choice of Chinese farmers.

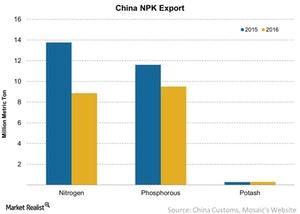

In 2016, China exported about 8.8 million tons of urea, which fell 35.0% year-over-year. The decline in exports was due to a curtailment of nitrogen capacity. The anthracite coal-based capacities were shut down in the country due to costs and environmental concerns.

Pressure on price to remain

Despite the capacity shutdowns, pressure on nitrogen fertilizer prices will continue in 2017 as a result of new capacity additions that will mostly take place in the United States (MOO). To find out more, read An Outlook on Global Fertilizer Capacity Additions. CF Industries (CF), PotashCorp (POT), Agrium (AGU), and Terra Nitrogen (TNH) are key producers in the United States.

Phosphate exports

Phosphate exports out of China in 2016 also fell year-over-year by 18.0% to 9.5 million metric tons. Under the umbrella of phosphate fertilizers, DAP (diammonium phosphate) exports fell 15.0% year-over-year in 2016. MAP (monoammonium phosphate) exports fell 25.0% year-over-year, while TSP (triple superphosphate) exports fell 22.0% for the same period.

Ammonia, which is the base for nitrogen fertilizers, is required for phosphatic fertilizers. With nitrogen capacity shutdowns, we can infer that phosphate fertilizer exports will also take a hit.

China is not a big producer of potash, but it exported 0.20 million metric tons of it in 2016. That was a 6.0% rise year-over-year. Next, we’ll take a look at China’s imports.