Can Delta Continue to Be the Best Airline Dividend Payer?

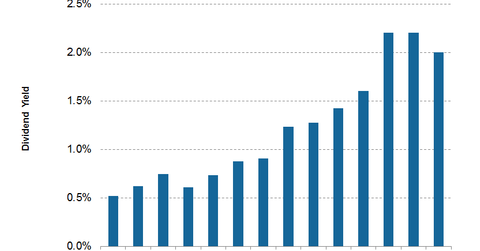

Delta Air Lines (DAL) has an indicated dividend yield of 2.0%, the highest among the four airlines that pay dividends.

July 18 2017, Updated 9:07 a.m. ET

Highest airline dividend yield

Delta Air Lines (DAL) has an indicated dividend yield of 2.0%, the highest among the four airlines that pay dividends. Alaska Air Group (ALK) has the next highest indicated dividend yield of 1.3%. American Airlines (AAL) has an indicated dividend yield of 0.81%. Southwest Airlines (LUV) has a dividend yield of 0.67%.

Cash dividend coverage ratio

DAL’s cash dividend ratio stands at a strong 6x at the end of 2Q17, indicating its ability to sustain dividend payouts. The ratio measures the ability of the company to pay dividends. A ratio of less than one indicates dividend payouts that are above the company’s cash flows, which may be difficult to sustain in the future.

Can dividend payouts increase?

Investors can expect DAL’s dividends to increase in the next quarter. Reuters analysts’ consensus also estimates dividends to rise to $0.28 for the next two quarters.

Despite being one of the best dividend payers among airline stocks, Delta Air Lines is nowhere close to the highest dividend payers in the market. For exposure to dividend stocks, investors can look at stocks like AT&T (T), which has a dividend yield of 5.3%, or Target (TGT) with a dividend yield of 4.9%.

To mitigate the risk of investing in a single stock, investors can consider the iShares Core High Dividend ETF (HDV), which has a dividend yield of 3.4%.