Behind Abiomed’s Plans to Create a Greater Awareness of Impella

To target patients across communities, Abiomed (ABMD) has been developing a hub-and-spoke model with hospitals.

July 24 2017, Updated 9:07 a.m. ET

Hub-and-spoke model

To target patients across communities, Abiomed (ABMD) has been developing a hub-and-spoke model with hospitals. Hospitals specializing in high-risk protected PCI (percutaneous coronary intervention) procedures will act as the hub for other generalist hospitals that primarily treat emergency patients.

If needed, patients can be sent from the generalist hospital to the hub hospital or heart recovery center. Abiomed plans to equip both the hub and spoke of the hospital system with Impella devices.

Abiomed has also been actively involved in creating awareness for its Impella family of devices. The company had 16 papers published about Impella in fiscal 4q17, while the total number of publications has reached close to 400.

The company also reached out to around 1,000 physicians to create awareness for Impella. Abiomed has also been actively making changes to consoles and other product features to adapt to the needs of physicians and nurses.

Notably, the SPDR S&P MIDCAP 400 ETF (MDY) has about 0.35% of its total portfolio in Abiomed.

Hospital site penetration rates

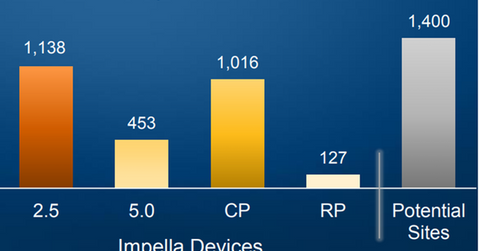

Due to its aggressive marketing strategy, Abiomed managed to place Impella 2.5 at 1,138 hospitals of the targeted 1,400 in the US, reaching a penetration rate of 81% in fiscal 4Q17. The penetration rate for Impella CP was 73%, while the Impella 5.0 rate was 32%. The rate of Impella RP was only 9%.

Notably, Abiomed expects to benefit from awareness initiatives by Abbott Laboratories (ABT) in the heart recovery space related to protected PCI procedures as well as risks associated with the intra-aortic balloon pumps used for hemodynamically stabilizing patients.

The Impella franchise has thus enabled Abiomed to compete effectively with other cardiovascular device players like Medtronic (MDT) and Stryker (SYK).