Will Weak Data from the EU Derail the Euro?

The euro (FXE) remained confined to a narrow range against the US dollar (UUP) in the previous week.

June 27 2017, Updated 7:43 a.m. ET

Weak EU data leaves the euro in a range

The euro (FXE) remained confined to a narrow range against the US dollar (UUP) in the previous week. Economic data from the euro area consisted of PMI reports and indicated a minor slowdown in German and European services and manufacturing sectors. Markit’s Eurozone Composite PMI Index turned lower to 55.7 from 56.8. The euro-dollar (EUO) pair traded in the range of 1.112–1.122 for the entire week and closed at 1.12.

European indexes also remained confined to narrow ranges with Germany’s DAX (DAX) closing 0.15% lower and the Euro Stoxx 50 (FEZ) closing 0.01% lower in the previous week.

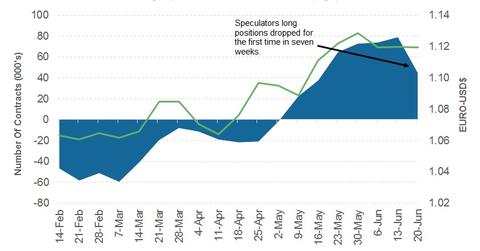

Euro bets lower for the first time in seven weeks

The net speculative bullish long positions on the euro fell for the first time in seven weeks as per the Commitment of Traders (or COT) report. There was a decrease of 35,000 long euro contracts, taking the total net speculative long positions to 44,900. This reduction in long positions reflects investors’ doubts after weak European data in the previous week. However, looking at the bigger picture, the outlook for the Euro area remains positive in the near term.

EU data and Draghi to be in focus this week

There are a few important data points to be reported from the euro area this week. German business expectations, retail sales, and unemployment rates are due to be reported and the European Central Bank president Draghi plans to speak this week. Draghi has tried to calm market enthusiasm about the European recovery with dovish guidance, but the recent recovery in the EU and the stable political backdrop will make it challenging for the ECB to defend its dovish stance.

In the next part of this series, we’ll analyze how the British pound is reacting to the UK’s political uncertainty.