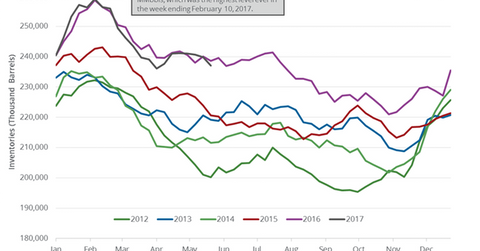

US Gasoline Inventories: More Concerns for Crude Oil Prices

US gasoline inventories are 7.2% below their all-time high. The expectation of a fall in gasoline inventories could support gasoline prices.

June 9 2017, Published 9:51 a.m. ET

US gasoline inventories

The EIA (U.S. Energy Information Administration) reported that US gasoline inventories rose by 3.3 MMbbls (million barrels) to 240.1 MMbbls between May 26, 2017, and June 2, 2017. Gasoline inventories rose 1.4% for the week ending June 2, 2017—compared to the previous week. A better-than-expected rise in gasoline inventories pressured gasoline and crude oil futures on June 7, 2017. Gasoline and crude oil (USL) (FXN) (PXI) futures fell 4.1% and 5.1%, respectively, on June 7, 2017.

Lower gasoline prices have a negative impact on oil refiners like Western Refining (WNR), Marathon Petroleum (MPC), and Tesoro (TSO). Likewise, lower crude oil prices have a negative impact on oil and gas producers like Stone Energy (SGY) and Triangle Petroleum (TPLM).

Gasoline production, imports, and demand

The EIA estimates that US gasoline production fell 496,000 bpd (barrels per day) to 9,934,000 bpd between May 26, 2017, and June 2, 2017. Production also fell by 188,000 bpd during the same period in 2016.

US gasoline imports rose by 84,000 bpd to 703,000 bpd between May 26, 2017, and June 2, 2017. Gasoline demand fell by 505,000 bpd to 9,317,000 bpd during the same period. However, gasoline demand is expected to hit a record this summer. To learn more, read US Gasoline Consumption Rose in May.

Impact of gasoline inventories

US gasoline inventories are 7.2% below their all-time high. The expectation of a fall in gasoline inventories due to a rise in gasoline demand could support gasoline prices. High gasoline prices could push crude oil prices higher.

In the next part of this series, we’ll take a look at US distillate inventories.