These Mining Companies Are Showing an Uptrend Correlation with Gold

When we try to interpret the performance of precious metals, it’s crucial to study the impact of metal price variations on mining shares.

June 29 2017, Updated 5:35 p.m. ET

Metals and miners

When we try to interpret the performance of precious metals, it’s crucial to study the impact of metal price variations on mining shares. This kind of correlation study is a great method for analyzing how miners move with respect to the metals that they mine.

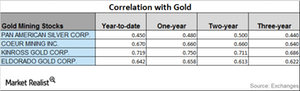

In this final part of our series, we’ll examine the correlations that Pan American Silver (PAAS), Coeur Mining (CDE), Kinross Gold (KGC), and Eldorado (EGO) have with gold.

Notably, leveraged mining funds like the Direxion Daily Gold Miners (NUGT) and the ProShares Ultra Silver (AGQ) also have strong correlations with gold. These funds have risen 3.1% and 6.6%, respectively, on a YTD (year-to-date) basis as of June 27, 2017.

Correlation trends

Among the above four mining companies, Kinross has the highest correlation with gold, while Pan American has the lowest correlation. Over the past three years, Kinross has seen upward correlations in its trends, while the other three mining companies have seen mixed trends in their correlations.

A rise in correlation means that there would be an increased tendency of a particular miner to react according to changes in gold.

Kinross has a three-year correlation of ~0.69 with gold and a one-year correlation of ~0.75. The correlation of ~0.75 means that Kinross has moved in the same direction as gold about 75% of the time over the past year.

But remember, you have to bear in mind that correlations can move in different directions at different times.