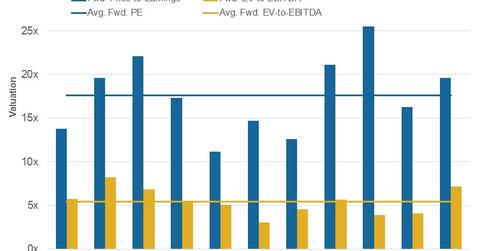

Shell’s Valuation Compared to Its Peers

Shell is trading at a forward PE of 13.8x, below its peer average of 17.6x.

Nov. 20 2020, Updated 11:37 a.m. ET

Shell’s valuation: PE below the peer average

Earlier in this series, we looked at Royal Dutch Shell’s (RDS.A) stock performance, analyst ratings, and dividend yield trend. In this part, we’ll consider Shell’s forward valuations in comparison to its peers. Let’s begin with its forward PE (price-to-earnings) ratio.

Shell is trading at a forward PE ratio of 13.8x, below its peer average of 17.6x. BP Plc (BP), Total SA (TOT), Statoil (STO), and Petrobras (PBR) are trading below the peer average, as illustrated in the chart below.

With respect to its EV-to-EBITDA[1. enterprise value to earnings before interest, tax, depreciation, and amortization] ratio, Shell (RDS.A) is currently trading at a forward EV-to-EBITDA multiple of 5.8x, marginally above the peer average of 5.4x.

Why does Shell trade below the average PE?

It’s likely that Shell trades below the peer average because the company has seen a sharp rise in its leverage in the past few years. This was primarily due to the acquisition of the BG Group. This acquisition came at a time when oil prices were at their multiyear lows.

Although oil prices are improving, and the benefits and synergies from the BG Group acquisition are ready to kick in, this move resulted in additional debt for the company.

Shell’s peers ExxonMobil (XOM) and Chevron (CVX), which have relatively comfortable leverage positions, have higher-than-average forward PE ratios. For more information on integrated energy companies’ debt, please read Did Integrated Energy Companies’ Leverages Improve in 1Q17?

In the next part, we’ll review Shell’s beta in comparison to its peers.