Phillips 66’s Beta: Does It Imply the Company Is Less Volatile?

Phillips 66’s 90-day daily beta stands at 1.1, which is below its peer average of 1.5.

June 2 2017, Updated 10:36 a.m. ET

Phillips 66’s beta

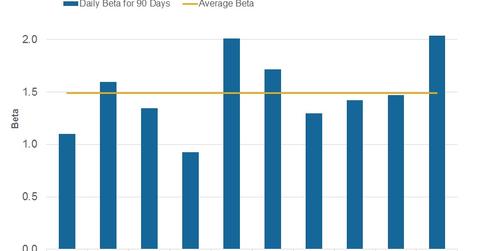

Let’s take a look now at Phillips 66’s 90-day daily beta, which shows how much the stock varies for a given variation in the market daily for 90 days. Phillips 66’s 90-day daily beta stands at 1.1, which is below its peer average of 1.5.

Betas for peers

Phillips 66’s (PSX) beta is the second-lowest among the refining stocks in the United States. The lowest is Valero Energy (VLO) at 0.90. The 90-day daily betas for Alon USA Energy (ALJ) and Delek US Holdings (DK) are both 2.0, the highest among the peers. The iShares Russell 2000 Value (IWN) can provide exposure to small-cap stocks. It also has a ~5.0% exposure to energy sector stocks, including DK and ALJ.

Larger players are showing a mixed trend. Tesoro (TSO) is trading at 1.3, which is below the average. Marathon Petroleum (MPC) at 1.6 is trading above the peer average.