Mining Stocks’ Relative Strength Index Hits Rock Bottom

The rise and fall of precious metals also significantly impact mining-based leveraged funds like the Direxion Daily Gold Miners (NUGT) and Proshares Ultra Silver (AGQ).

June 19 2017, Published 1:16 p.m. ET

Mining stocks

The rise and fall of precious metals also significantly impact mining-based leveraged funds, like the Direxion Daily Gold Miners (NUGT) and Proshares Ultra Silver (AGQ). These funds fell on Friday, by 0.95% and 1.3%, respectively

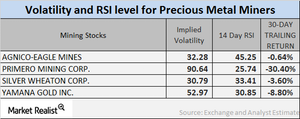

Below, we’ll examine the implied volatilities and RSIs (relative strength indexes) for Silver Wheaton (SLW), Franco-Nevada (FNV), Randgold Resources (GOLD), and Yamana Gold (AUY).

Implied volatility

The call implied volatility is the option-related volatility of an asset. It measures the price fluctuations of an asset with respect to variations in the price of its call option.

On June 16, the implied volatilities of Silver Wheaton, Franco-Nevada, Randgold, and Yamana stood at 30.8%, 25.4%, 26.5%, and 48.5%, respectively. But we have to remember that mining stock volatility is often greater than the volatility of the precious metals themselves.

RSI levels

The 14-day RSI level reflects an asset’s overbought or oversold situation. If the RSI crosses the 70 level, it means there’s a chance of a downward correction in price. A level below 30 suggests that prices may bounce back.

RSI scores often rise and fall when a company’s stock price increases and drops. Silver Wheaton, Franco-Nevada, Randgold, and Yamana have current RSI scores of 26.8, 43.8, 45.7, and 32.2, respectively.

The next article looks at the correlation trends of a few other miners.