Japan’s Manufacturing PMI in May, and What to Make of It

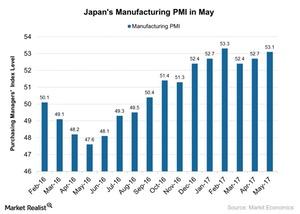

The Japan Manufacturing PMI stood at 53.1 in May 2017, as compared to 52.7 in April, outperforming the preliminary market estimation of 52.0.

June 15 2017, Updated 6:06 p.m. ET

Japan Manufacturing PMI in May

The Japan Manufacturing PMI (purchasing managers’ index) stood at 53.1 in May 2017, as compared to 52.7 in April, outperforming the preliminary market estimation of 52.0.

The Japan Manufacturing PMI showed a huge contraction between March and August 2016. However, this manufacturing PMI in May showed improvement over April. Remember, a level above 50 indicates an expansion in manufacturing activity, while a level below 50 indicates contraction in manufacturing activity.

The improvement in the Japan Manufacturing PMI in May was mainly driven by stronger improvements in new orders, production output, and export orders in Japan. Japan’s (EWJ) (DXJ) first quarter economic growth showed 0.5% growth, which beat the market expectation of 0.4% growth. Improvements in domestic demand, which rose 0.4% in the first quarter, contributed the most to Japan’s GDP.

These indicators show that personal income is improving gradually in the Japanese economy, which could push up consumer spending in the near future. Japan’s economy also highly depends on its export business and overseas (ACWI) (VTI) (VEU) demand. The improvement in exports is another positive point for the country.