Is the Fed Sure What It’s Doing?

In this series, we’ll analyze Fed members’ comments in June 2017 to better understand their outlooks on the US economy and how they justify their hawkish or dovish stances.

Nov. 20 2020, Updated 5:21 p.m. ET

Did the Fed fall into its own trap?

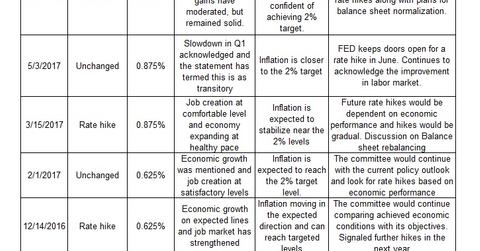

In the June 2017 Federal Open Market Committee (or FOMC) meeting, the members of the Federal Reserve decided to increase the US interest rate by 0.25%. This was the third interest rate hike in 2017, marking a total of five rate hikes since the tightening cycle began in December 2015.

The Fed has been carefully preparing the market for these rate hikes by giving advanced signals through economic projections, Fed member speeches, and forward guidances in meeting statements and minutes. The June FOMC meeting was a perfectly orchestrated, with the market’s pricing in a 90% probability of a rate hike.

The Fed had to stick to its plan of raising the interest rates in June despite a slowdown in 1Q17 growth and inflation. In fact, the Fed went overboard and announced its intention to hike once more this year, with four more hikes to come in 2018. It also detailed a plan to unwind its massive excess reserves. All these projections come with one caveat: The US economy must continue to improve as expected.

To learn more about the FOMC’s June 2017 meeting statement, read Why the FOMC Surprised Markets with a Hawkish Statement.

Is the optimism justified?

It’s important for the markets to question such optimism, especially when recent economic indicators paint a different picture. The evidence for such questioning lies in the falling yield spreads between short-term (SCHO) and long-term US treasuries (GOVT).

Bond market (BND) traders are pricing in rate hikes at the lower end of the curve. Yields are rising in US T-bills (SHY) and 2-year bonds, but similar actions are missing in bonds (TLO) with longer timelines as market inflation expectations diverge from the Fed’s guidance.

Series Overview

Throughout this series, we’ll analyze Fed members’ comments in June 2017 to better understand their outlooks on the US economy and how they justify their hawkish or dovish stances.